Formidable Gaap Accounting For Factoring

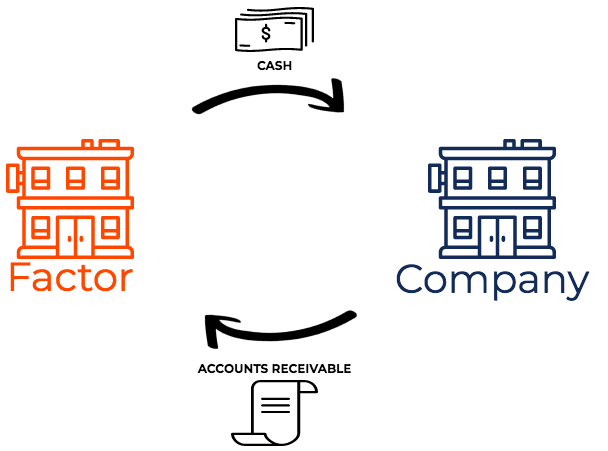

Accounts receivable factoring is also known as invoice factoring or accounts receivable financing.

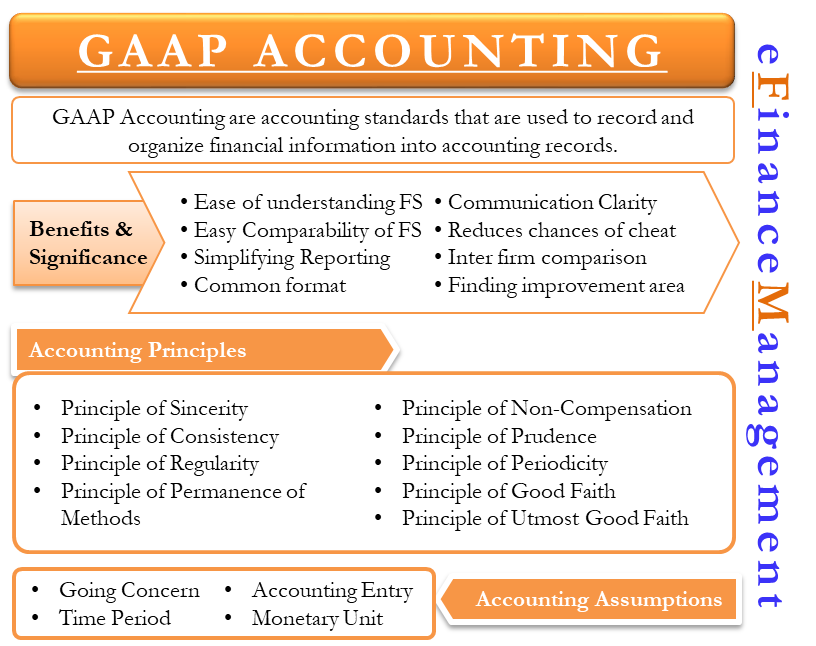

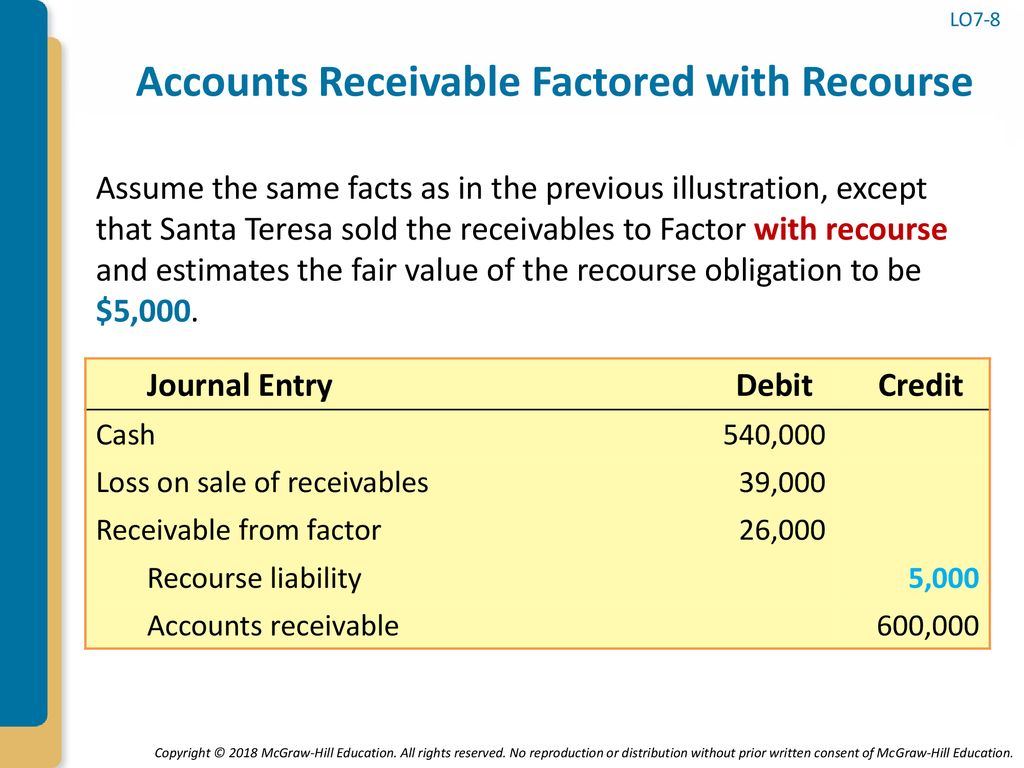

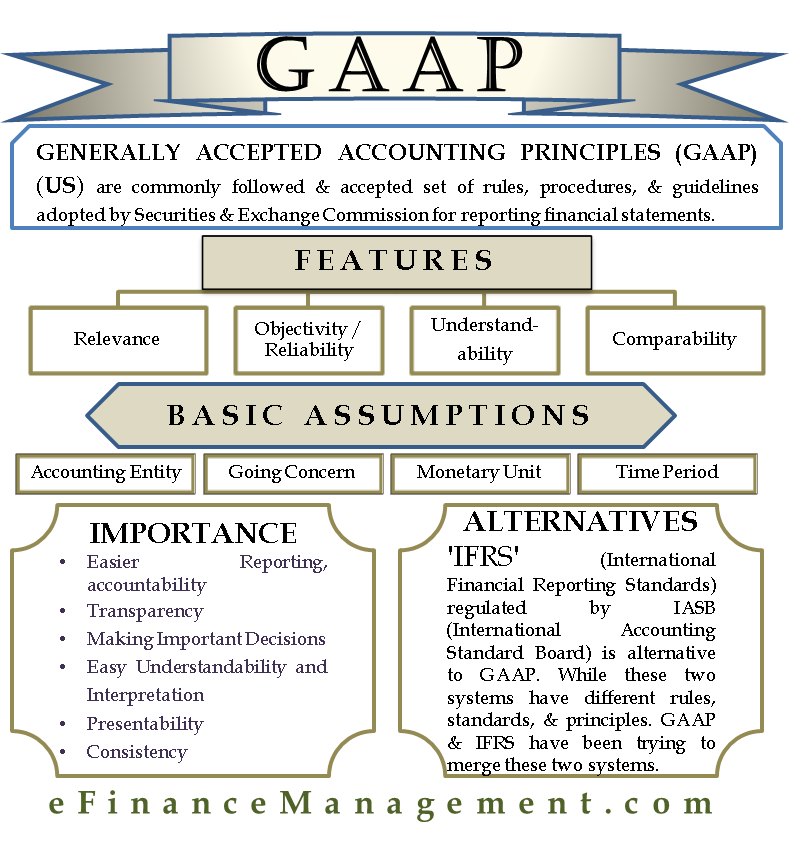

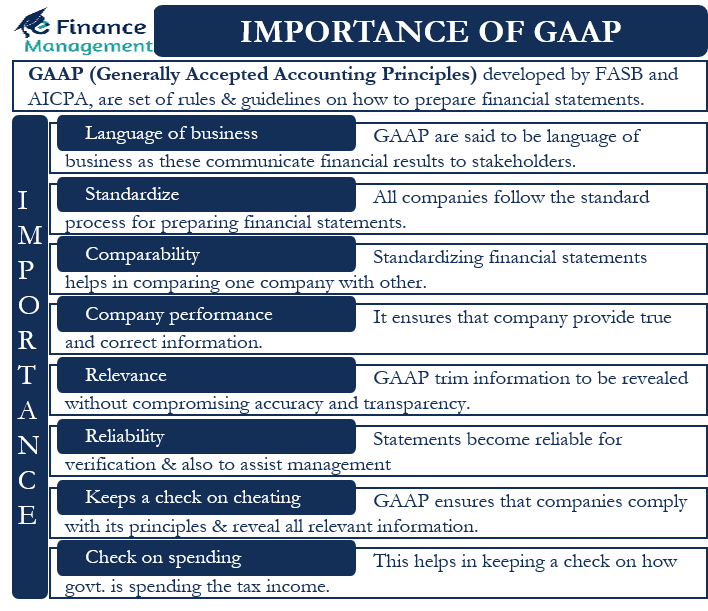

Gaap accounting for factoring. Companies often transform liquid assets into securities that can be sold or transferred to fund working capital and liquidity needs. Accounts receivable factoring also known as factoring is a financial transaction in which a company sells its accounts receivable to a finance company that specializes in buying receivables at a discount called a factor. Your fee for having cash immediately interest on the loan provided by the factor The revenue of the factoring company.

Sell goods to customers on credit terms and generate invoices. Integrated Cash Management Tools. 5 At the month end.

Debt Factoring Accounting Treatment. Under a factoring arrangement the customer is notified that it should now remit payments to the factor. Factoring is a common practice among small companies.

Factoring accounts receivable allows you to obtain cash advances from the factoring company which frees up cash from working capital. Factoring also known as invoice factoring is a financial transaction in which a company sells its accounting receivables. There are sometimes referred to as securitizations.

Factoring involves the sale of receivables to a finance company which is called the factor. Assuming a 100000 receivable with an 80 advance rate. The Factoring Company assesses a finance charge of 3.

Accounting for Factored Receivables Accounting for factored receivables is one of the more troublesome issues for controllers of entrepreneurial and middle-market companies. The accounting for factoring arrangements of accounts receivable is different for both the business selling its receivables and the factor. 4 When invoices are paid to Factor.