Ideal Income From Passthrough Statement

One of the most valuable tax breaks in the Tax Cuts and Jobs Act TCJA is the new deduction for up to 20 percent of qualified business income QBI from pass-through entities.

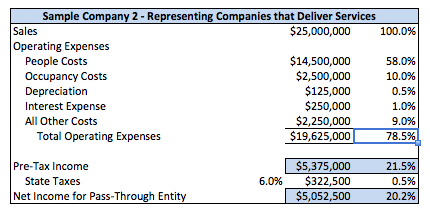

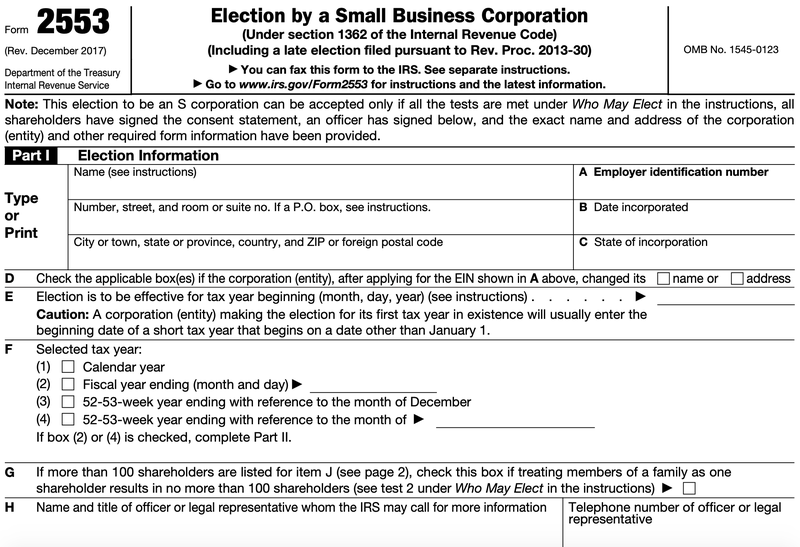

Income from passthrough statement. Pass through income is sent from a pass-through entity to its owners. Accordingly C corporation financial statements may contain current and deferred income tax expenses and assets and liabilities not found on PTE financial statements. This deduction began in 2018 and is scheduled to last through 2025that is it will end on January 1 2026 unless extended by Congress.

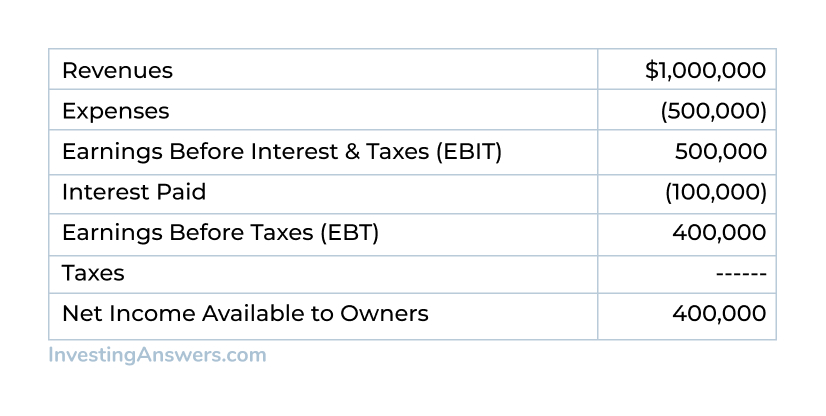

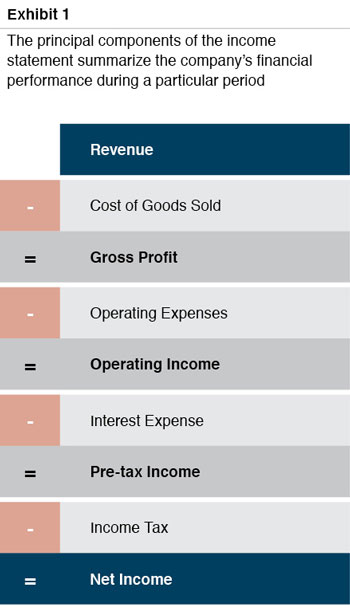

An entity usually pays tax twice one for the income generated by the firms shareholders and another at a corporate level which is corporation tax. In Box 40 - Income from passthrough statement print. Some aspects of income statements may seem obvious but other parts of income statements might leave you stumped.

Those business entities that enjoy pass-through income status -- which include sole proprietorships limited liability companies partnerships and. If no entry is made in line 39 than the system will default to the detailed format for the income from passthrough statement. PTE financial statements may contain.

In 2017 individuals reported about 103 trillion in net income from all types of pass-throughs accounting for 93 percent of total AGI reported on individual income tax returns figure 3. Use Schedule E Form 1040 to report income or loss from rental real estate royalties partnerships S corporations estates trusts and residual interests in real estate mortgage investment conduits REMICs. Alternatively click Income from Passthrough Statement - Simplified.

Click Income from Passthrough Statement - Detailed. When a pass-through entity is a member of a group that files a consolidated tax return ASC 740-10-30-27A provides an accounting policy election for allocating consolidated income tax expense to the reporting entity if the reporting entity is both not subject to tax and disregarded by the taxing authority. Such funding may be classified as dividends compensation andor loans.

Net Operating Income Other Income. If so then you would accrue the expense and recognize accrue income on the job in proportion to the expected job profit margin. Gain Loss on Sale of Assets Interest Income Total Other Income Net Income Loss For the Year Ended Mmmm Dd 200X This automated form is made available compliments of CCH Business Owners Toolkit Page 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 0.