Fine Beautiful Income Statement Reports Deferred Tax Disclosure Example

For example we refer to income statement and statement of other comprehensive income rather than profit and loss account and statement of total recognised gains and losses.

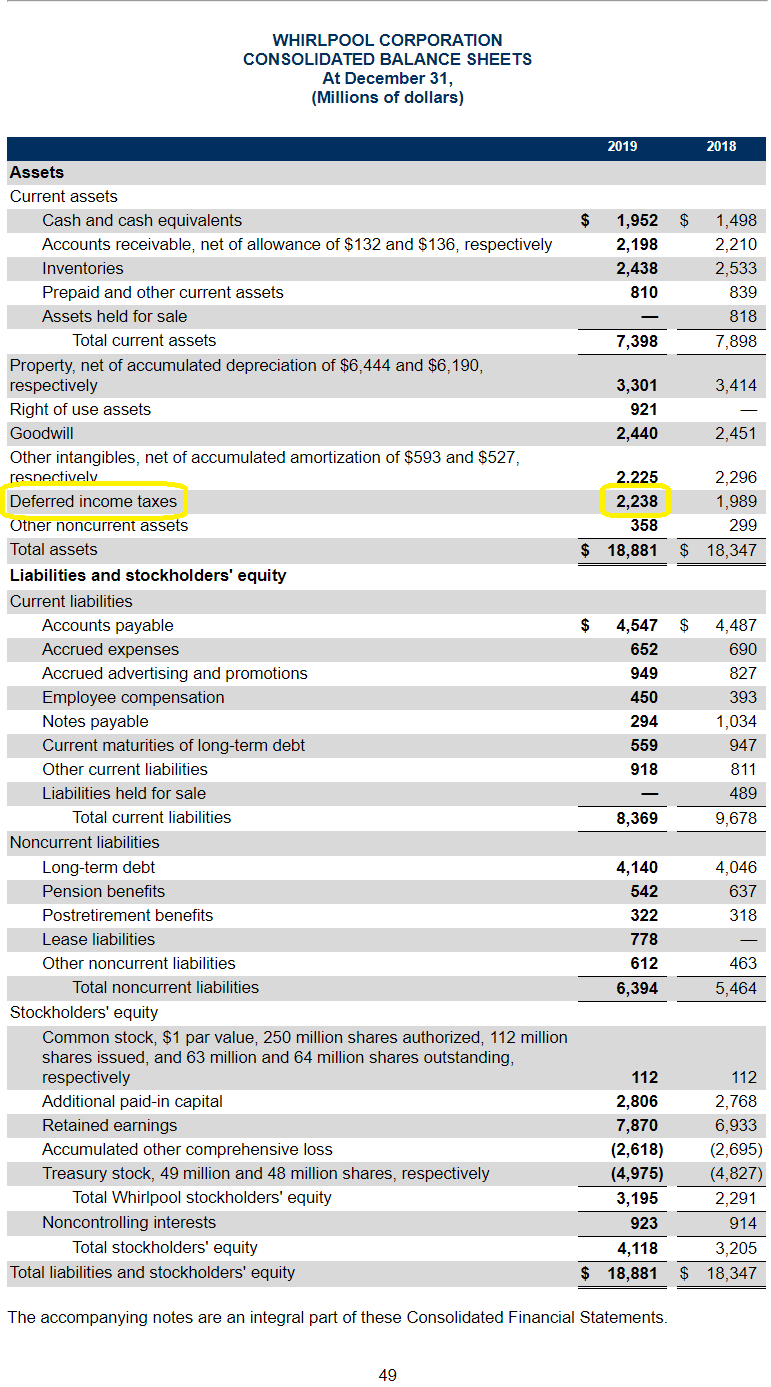

Income statement reports deferred tax disclosure example. The illustrative financial statements include the disclosures required by the Singapore Companies Act SGX-ST Listing Manual and FRSs and INT FRSs that are issued at the date of publication August 31 2017. Depreciation expenses can generate deferred tax liabilities. Deferred income taxes are provided on timing differences between financial statement and income tax reporting principally from the use of the percentage of completion method of accounting for financial statements and the completed contract method of accounting for tax reporting purposes.

Presentation of Items of Other Comprehensive Income Amendments to IAS 1. Examples from IAS 12 Example 2 - Illustrative disclosure representing some of the disclosures required by IAS 12 for income taxes using block and detailed XBRL tagging. IFRS Example Consolidated Financial Statements 31 December 2018 Using the Example Financial Statements The Appendices illustrate an alternative presentation of the statement of profit or loss and the statement of comprehensive income and contain an overview of effective dates of new Standards.

The following section explains IAS 12 deferred tax examples with other IAS 12 disclosure requirements. As at 31 December 20X7 it has also claimed tax allowances in excess of depreciation of 60000. Major components of tax expense.

The amounts to be disclosed in accordance with the Standard are as follows. Unrelieved tax losses and deferred tax liabilities As at 31 December 20X7 Entity A has unrelieved corporation tax losses of 50000. We refer to inventories and property plant and equipment rather than stocks and work in progress and tangible fixed assets.

IFRS for example current or deferred tax assets and liabilities in accordance to IAS 12p71 and IAS 12p23. Measuring assets net of valuation allowances - for example doubtful debt allowances on receivables - is not offsetting. Tax Disclosures 8 Corporate Reporting Thematic Review details of large differences between the current tax charge and tax paid where the reason was not clear from the primary statements.

A deferred tax liability means that taxable income will be higher in future years than income reported in the accounting records. So theres a deferred tax liability called Capital assets. Now lets do another example for a depreciation expense so we can go through exercise with a deferred tax liability.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)