Impressive Financial Ratios For Suppliers

Suppliers rely more on certain items than.

Financial ratios for suppliers. Financial ratios can also be used by managers within a firm by current and potential. These ratios are derived by dividing one financial measurement by the other. So the company can use cash for other purposes before paying it to suppliers.

Accounts payable turnover shows how many times a company. The tools incorporate a set of 62 financial ratios that produce a single predictive overall Financial Health Rating FHR on an industry-specific basis. There are many variety ratios including current ratio quick ratio defensive interval ratio cash ratio and working capital ratio.

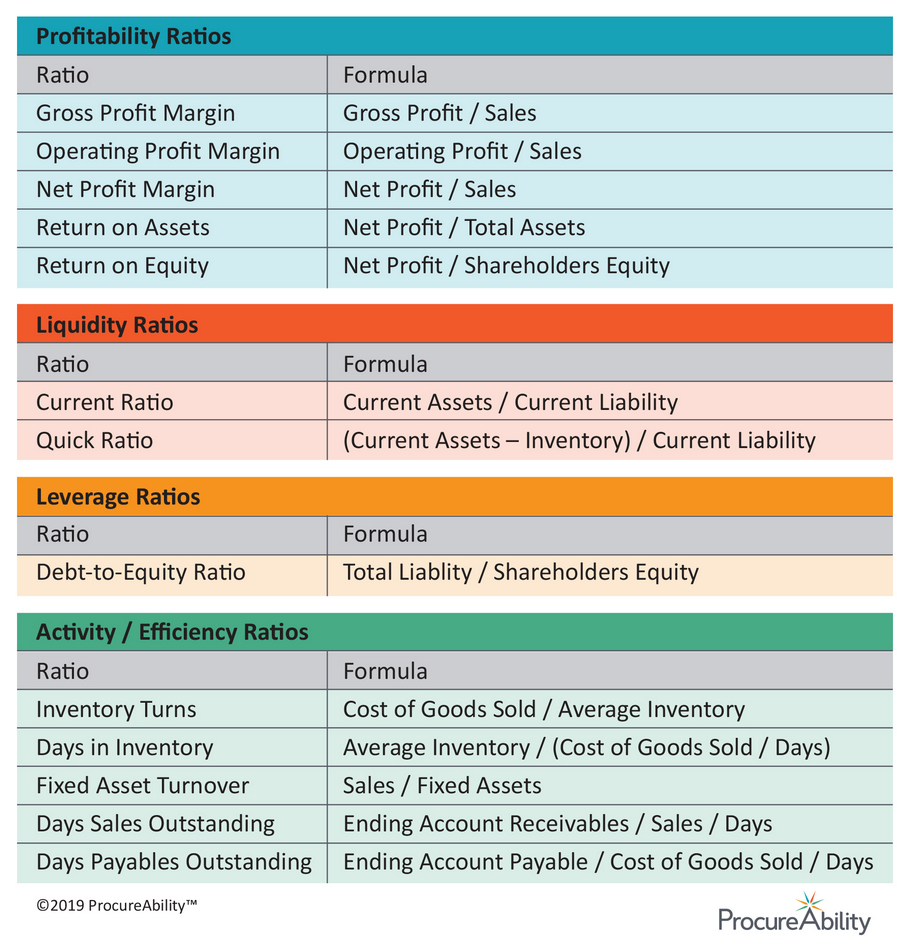

Financial data is a loose term referring to a hodgepodge of items running the gamut from financial statements and budgeting information to economic reports and data summaries about a specific sector or region. Care should be used in applying the ratios as standards vary between industries. These ratios help a procurement professional understand if the supplier can generate sustainable revenue and control costs.

The ratios provide the equivalent of an MRI magnetic resonance imaging scan that provides deep insight into the inner workings of the company and its level of resilience and efficiency. The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. Financial ratios are useful in understanding the companys financial condition and performance including for.

Financial Ratios to Spot Companies in Financial Distress. Is significantly lower than the average of its sector Industrial Suppliers. Liquidity ratios are the group of financial ratios that measure an entity financial ability to pay its short term debt.

They use solvency ratios to rigorously analyze whether the company will be able to make good its obligations in the long run. Grab for cashalso witnessed when companies suddenly start selling off core business assetscould be a sign that suppliers or. Conversely a high ratio indicates the company spends money faster reducing the companys financial flexibility.