Peerless Manufacturing Industry Average Financial Ratios

Average financial ratios by industry - something Join Login.

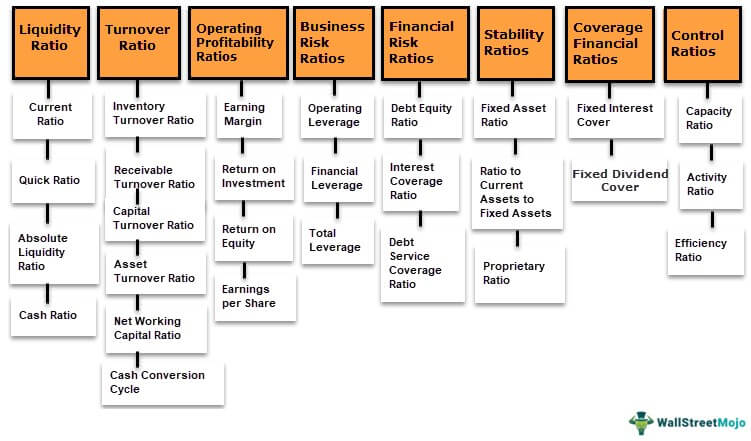

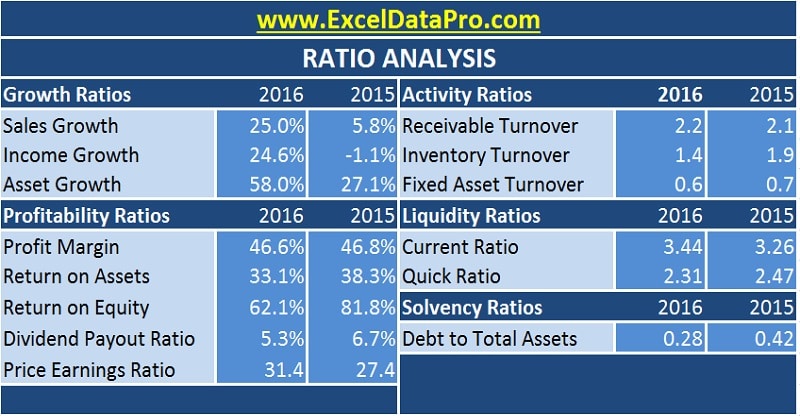

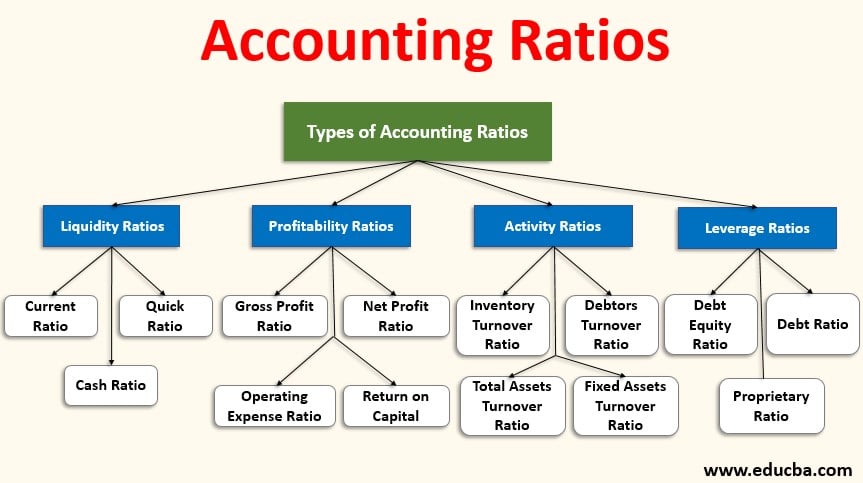

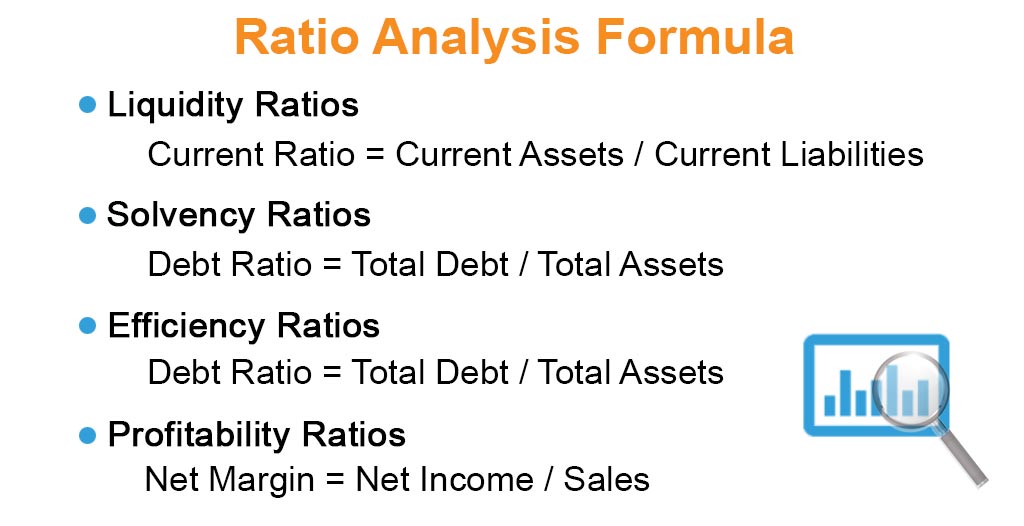

Manufacturing industry average financial ratios. On the trailing twelve months basis Current Liabilities decreased faster than Industrys Current. The two most used and effective financial analysis methods employed are ratio analysis and common size financial statements. Debt to equity ratio.

Beginning inventory ending inventory2. This Financial Analysis Benchmarks Report Was Published on 6292021 and Includes. Lower the Inventory turnover ratio implies that the manufacturing entity is at a greater risk for inventory.

22 rows Activity Ratios. Average inventory is calculated as. Your source for the most current industry analysis using industry ratios.

Credit Given Days 33. Industry Norms and Key Business Ratios. The Industry Watch Service provides industry averages for all sectors of UK industry.

Asset turnover days 617. Xx lock Purchase this report or a membership to unlock the average company profit margin for this industry. 10 or 110 10 or 10.

Manufacturing in the US industry outlook 2021-2026 poll Average industry growth 2021-2026. Revenue to equity ratio. Say you have 100000 in Total Assets and 1000000 in Net Sales your Assets to Sales would be 100000 1000000 or 1.