Wonderful Qualified Opinion Opening Balances Example

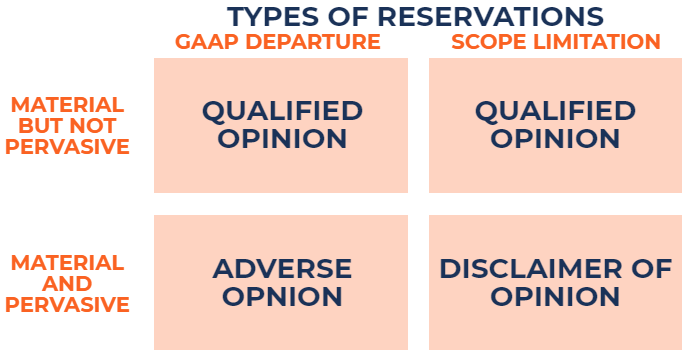

A the current periods accounting policies are not consistently applied in relation to opening balances in accordance with the applicable financial reporting framework or b a change in accounting policies is not appropriately accounted for or not adequately presented or disclosed in accordance with the applicable financial reporting framework the auditor shall express a qualified opinion.

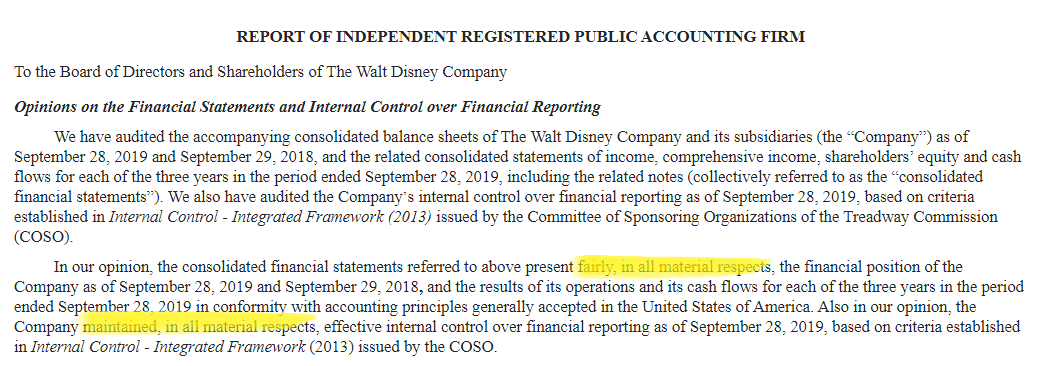

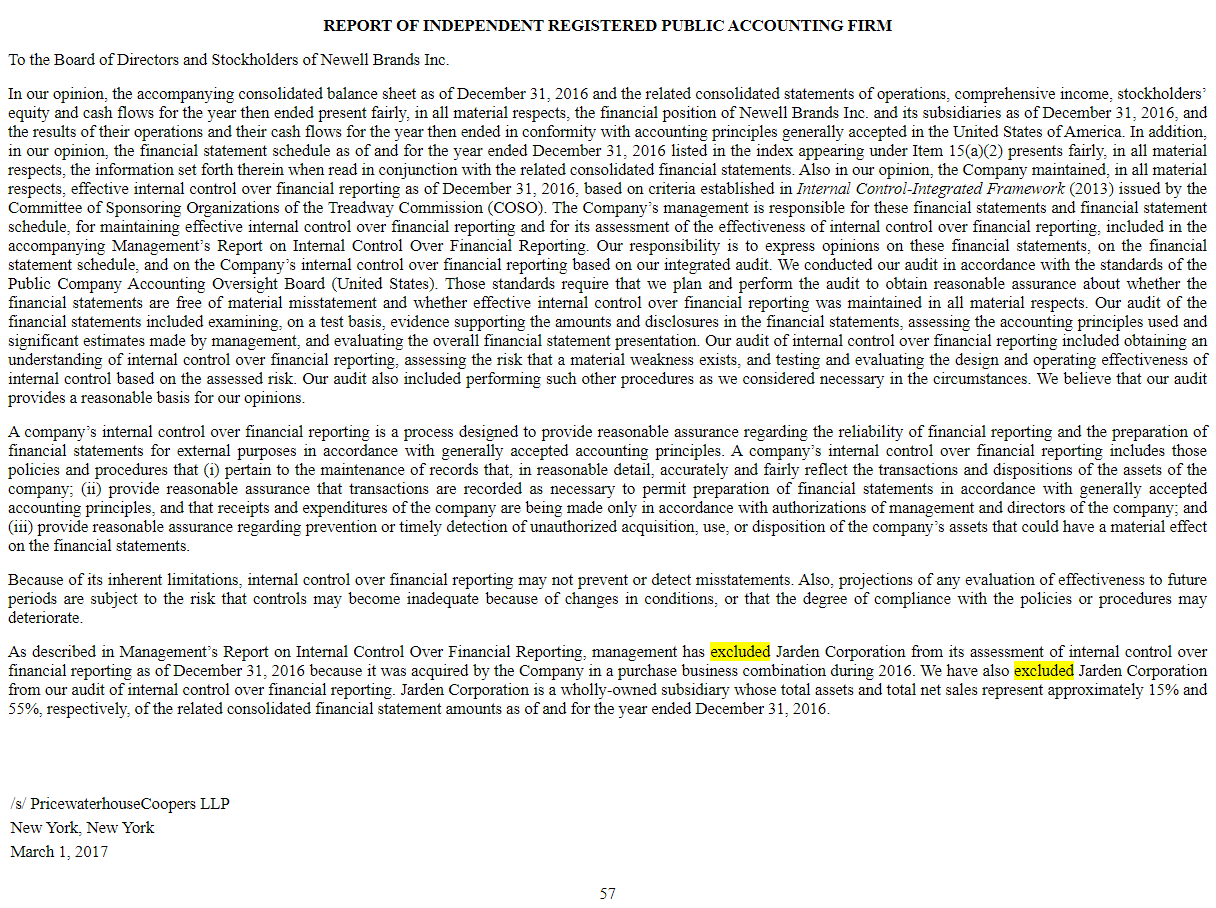

Qualified opinion opening balances example. Balances the auditor shall express a qualified opinion or disclaim an opinion on the financial statements as appropriate in accordance with SSA 705. When the auditor modifies the audit opinion the auditor shall use the heading Qualified Opinion Adverse Opinion or Disclaimer of Opinion as appropriate for the Opinion section. A17 A19 Qualified Opinion.

Qualified opinion for no provision of accrued expenses in financial statements should be on departure from HKAS 1 accrual basis under HKAS 1 provision under HKAS 37 prepayment under HKAS 9 but not including non-refundable prepayment. Opening balances also include matters requiring. If the auditor concludes that.

An example of an auditors report where the auditors are unable to obtain sufficient appropriate audit evidence concerning opening balances is. A disclaimer of opinion regarding the results of operations and cashflowsandanunmodifiedopinionregardingfinancialposition. The amount owing was consequently repaid subsequent to the financial year end by way of assignment of debts to a director of the Company in which this director undertook to pay the full amount of this debt to the Company.

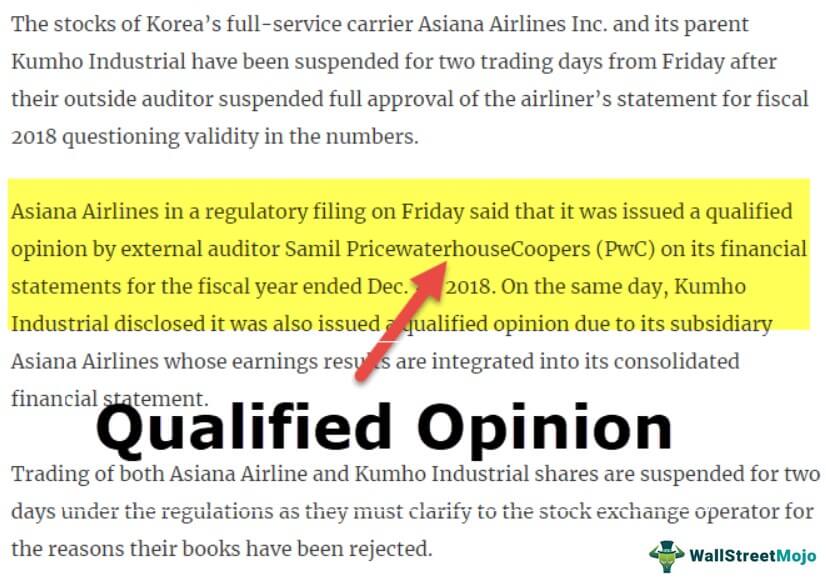

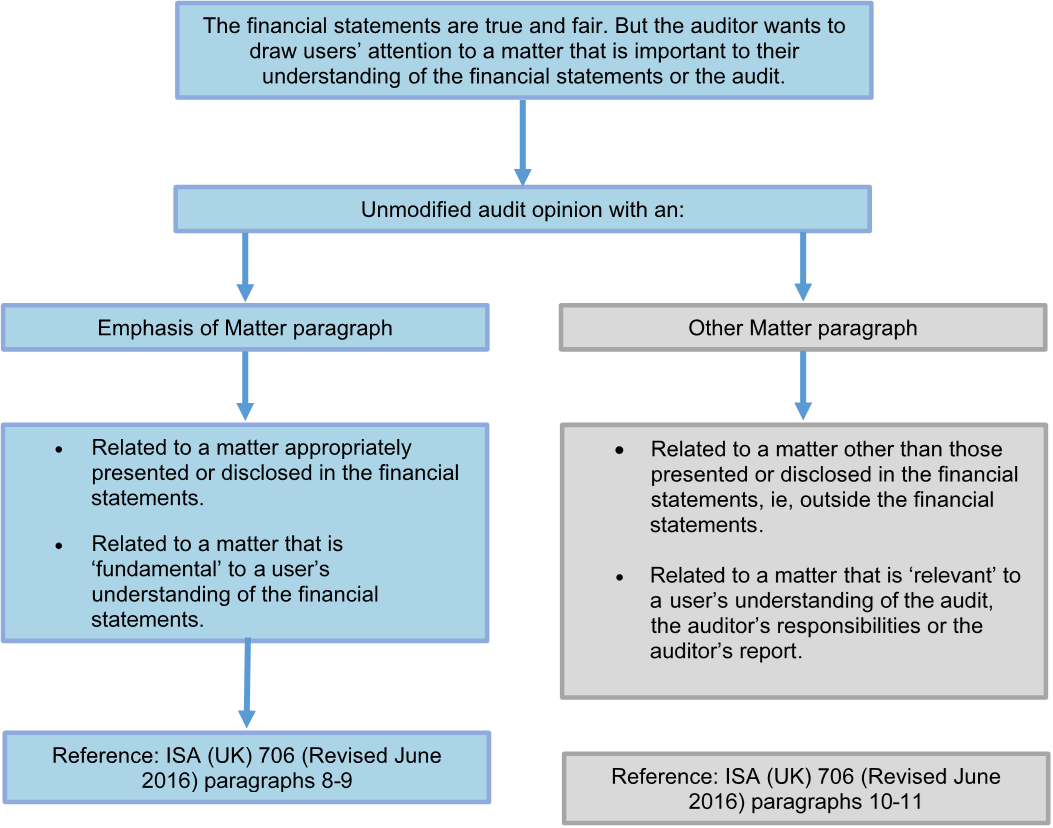

Opening balances are based upon the closing balances of the prior period and reflect the effects of transactions of prior periods and accounting policies applied in the prior period. A qualified opinion is not the same as an adverse opinion which is a more severe cautionary report. If the accounting policies have not been consistently followed and if the change has not been properly accounted for or disclosed the auditor should express a qualified opinion or adverse opinion.

Ate audit evidence regarding opening balances of inventory are deemedtobematerialandpervasivetotheentitysresultsofop-erationsandcashflows1 Thefinancialpositionatyear-endisfairlypresented. In the Basis for Modification paragraph in the auditors report the auditor shall either. We were not appointed as auditors of the company until September 15 206.

Inability to verify opening balances Qualified opinion. If the auditor concludes that the opening balances contain a misstatement that materially. AUS 510 INITIAL ENGAGEMENTS OPENING BALANCES APPENDIX EXAMPLE OF AN AUDITORS OPINION QUALIFIED DUE TO A LIMITATION ON THE SCOPE OF THE AUDITORS WORK INDEPENDENT AUDIT REPORT To addressee Scope We have audited the financial report of XYZ for the year ended 30 June 19X1 as set out on pages X to Y.