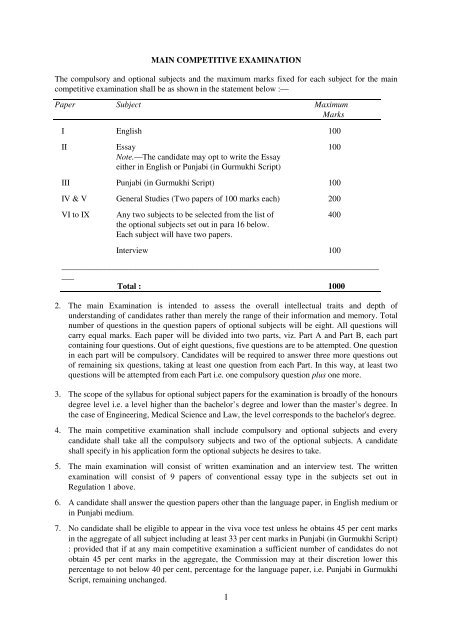

Fun Preparation Of Trial Balance Is Compulsory Or Optional

5 Which item is shown as debit balance in the Trial Balance a Cash in Hand.

Preparation of trial balance is compulsory or optional. Helps you understand the legal side of the business and different laws that are essential and applicable for the organizations. Ad Over 2000 Essential Templates to Start Organize Manage Grow Your Business in 1 Place. The exceptions are mandatory not optional.

Preparing a trial balance for a company serves to detect any mathematical errors that have occurred in the double-entry accounting system. IAS 1 sets out the overall requirements for financial statements including how they should be structured the minimum requirements for their content and overriding concepts such as going concern the accrual basis of accounting and the currentnon-current distinction. Focuses on the main principles of accountings including the double-entry system trial balance preparation of financial statements recording transactions etc.

The standard requires a complete set of financial statements to comprise a statement of financial position a statement of. It is prepared either using total method or balance method or compound method. B Question A Trial Balance shows a only credit balance.

C both debit and credit balances. F3 Financial Accounting. The trial balance can be prepared on daily or monthly or yearly basis as per the requirement of the business.

Rent paid Rs900 was credited to rent ac will be rectified by. C compulsory or optional. D None of these.

Crediting suspense ac with 900 c. Question Preparation of a Trial Balance is a compulsory. Debiting rent ac with 1000 Ans a.

:max_bytes(150000):strip_icc()/GettyImages-637850838-da3fbf72690a48f4891c55c553358807.jpg)

:max_bytes(150000):strip_icc()/GettyImages-931502252-1a04fb68be1d4404b2d6969a6fd20c4b.jpg)

:max_bytes(150000):strip_icc()/business-woman-analyzes-investment--983130558-3801931007d14f08a4245334ad12f8e4.jpg)