Unique Deferred Rent Cash Flow Statement

Compile the total cost of the lease for the entire lease.

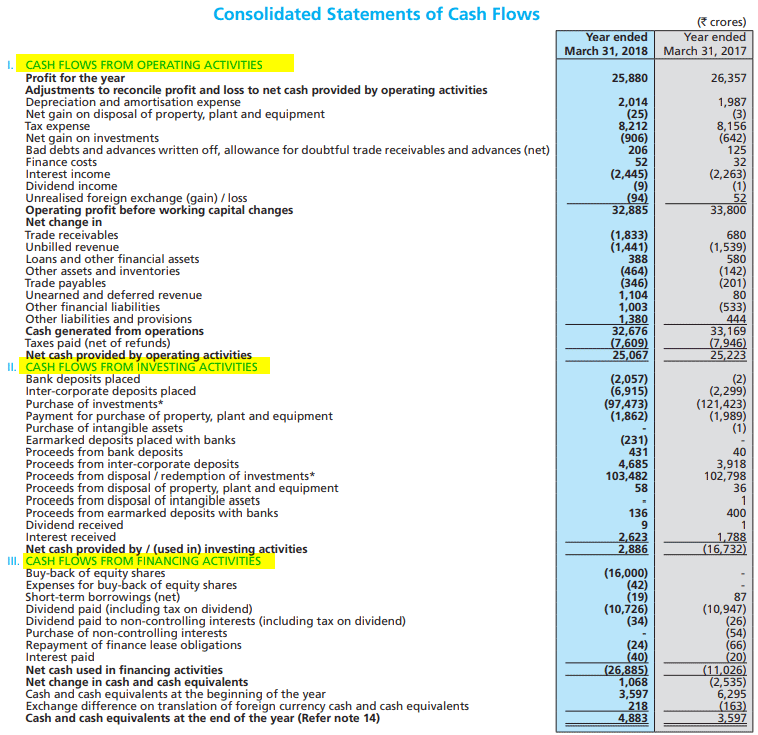

Deferred rent cash flow statement. Thats because the purpose of the section is to identify the cash impact of all assets and liabilities tied to operations not just current assets and liabilities. Purchase of marketable securities-275M. Footnote disclosures would show current year rent expense and commitments for contractual obligations to pay for the next five.

Deferred revenue flows between the balance sheet and the income statement as revenue. Cash flow statements are important for investors because they show how a company is spending its money where its money is coming from and other details about operations. The gym received a 1000 payment.

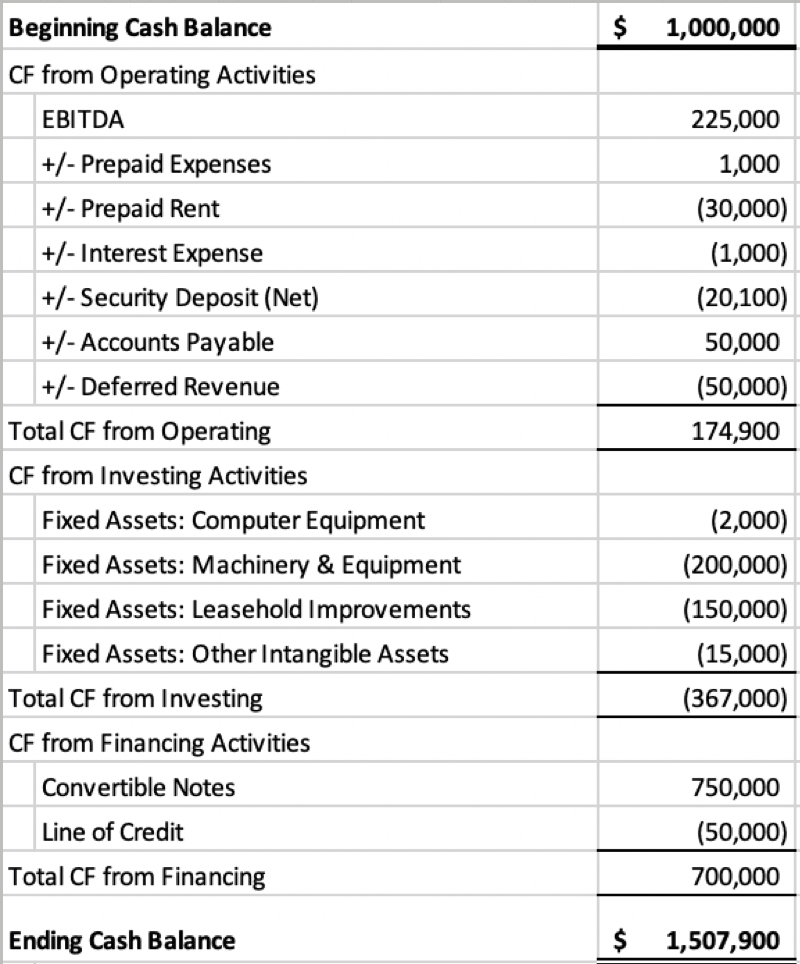

However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters. For example Noodles Co classifies deferred rent as a long-term liability on the balance sheet and as an operating liability on the cash flow statement. Refinancing of borrowings with a new lender 6.

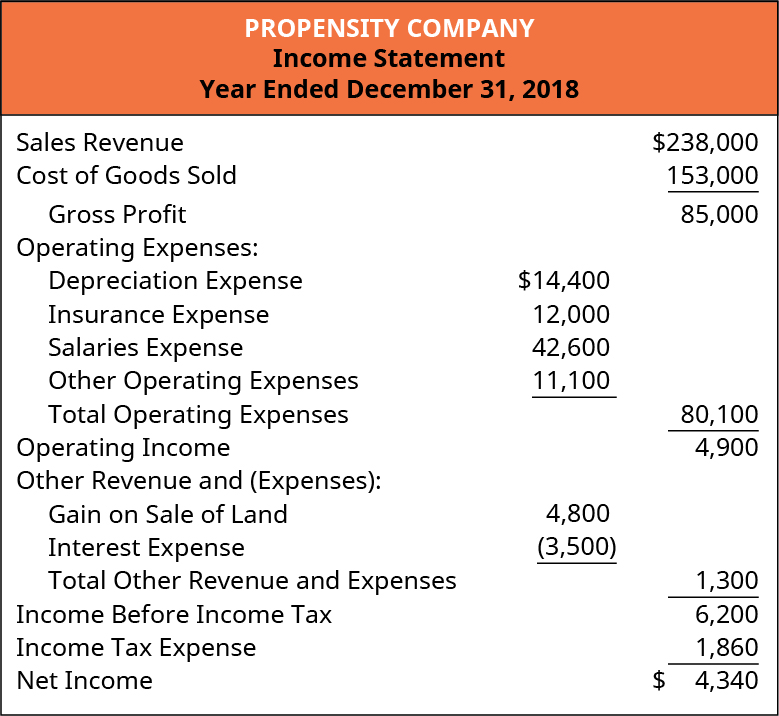

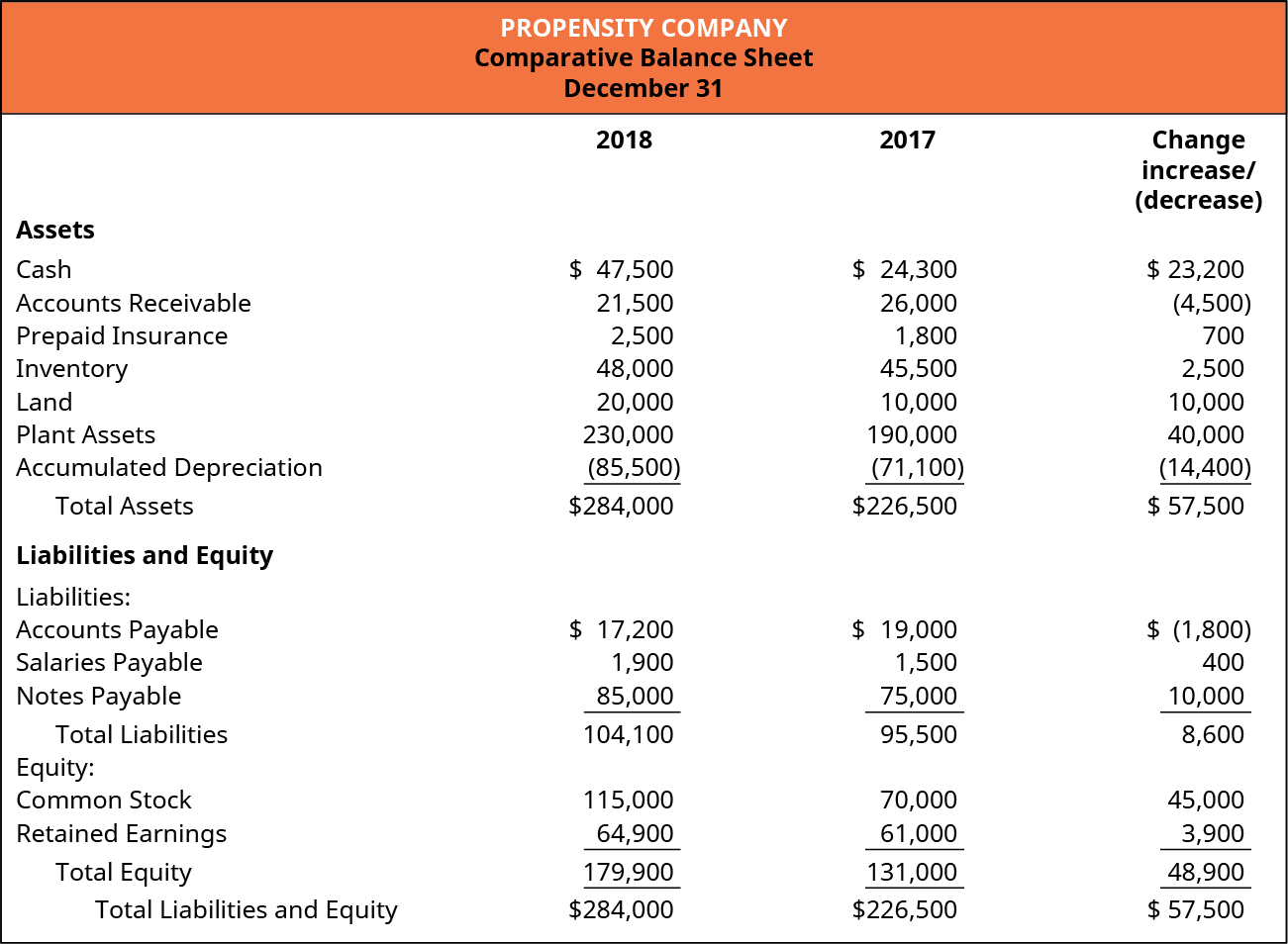

When your company receives a customer deposit or prepayment on a sale that payment occurs in advance of the actual sale and is therefore considered unearned revenue. Deferred Revenue In accrual-basis accounting the accounting method used by all major corporations a company records revenue when it earns money -- not when it receives money. Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year.

On August 31 the company would record revenue of 100 on the income statement. The statement of cash flows primarily that in ASC 2301 The accounting principles related to the statement of cash flows have been in place for many years. To account for these free periods as well as subsequent periods the essential accounting is as follows.

Rent is a common expense for a business. Typically the term of the lease is the amortization period used. If the lessee owns the improvements then the lessee initially records the allowance as an incentive which is a deferred credit and amortizes it over the lesser of either the term of the lease or the useful life of the improvements with no residual value.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)