Beautiful Vat Treatment In Profit And Loss Account

If we consider the above example and a VAT rate of 10 you would have paid VAT of Rs.

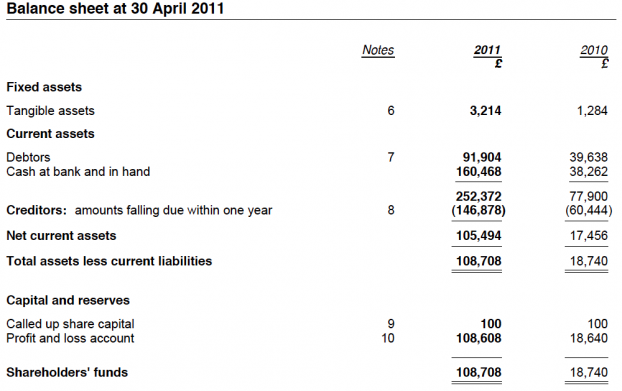

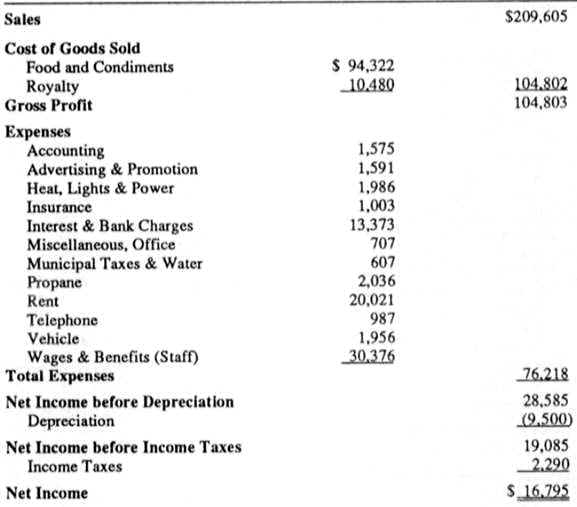

Vat treatment in profit and loss account. Deferred income tax liabilities. Taxes appear in some form in all three of the major financial statements. It is prepared based on.

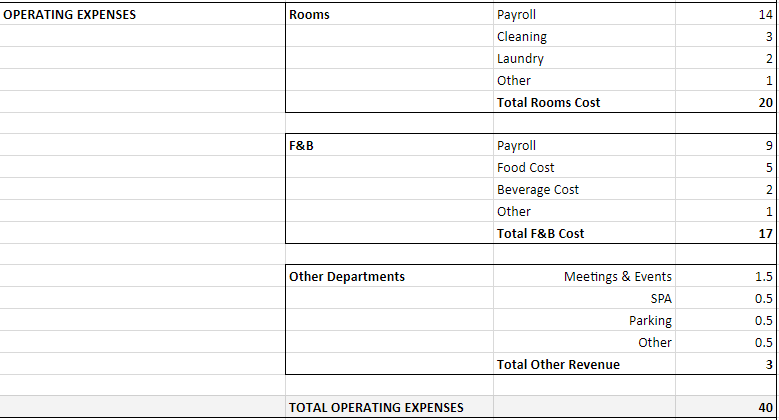

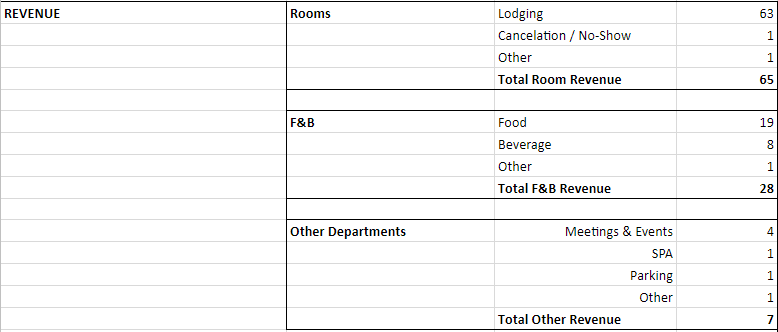

DR the VAT control account and CR Bank and a VAT recovered account in the relevant proportion. Preparation of the profit and loss account. Every VAT quarter you must clear the VAT control account which you have been faithfully stuffing with all those 175 chunks from the invoices.

1050- and like wise for purchases. Expenditure from the profit and loss account excluding salaries. The way that our system calculates Flat Rate vat is based on a methodology that calculates the difference ie.

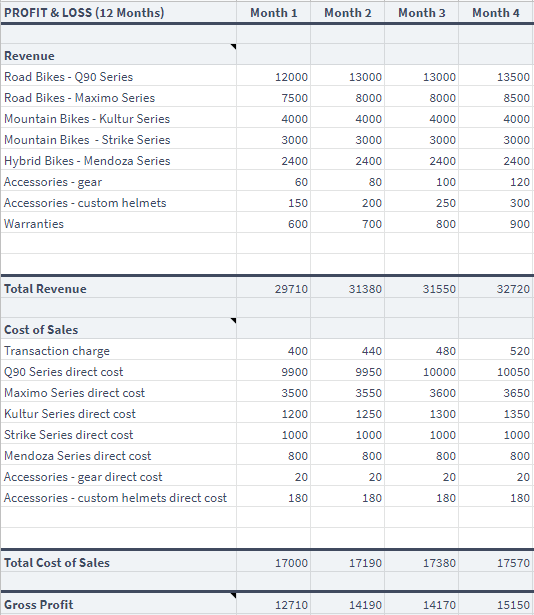

Our method of calculation allows you to know exactly if its worthwhile being on the FRS scheme or not. Ad Find Profit Loss Statements. The PL statement shows a companys ability to generate sales manage expenses and create profits.

The VAT amount of Rs 125000 should be debited to the VAT account and ultimately reflected as Input Tax. Ad Find Profit Loss Statements. VAT is added to all of these to calculate the trade creditors figure and the VAT is entered onto the VAT line as a debit to complete the double entry for trade creditors.

Similarly at the time of sale you must have charged VAT 10 on Rs. Accounting treatment for VAT paid on purchases The amount of tax paid on purchase of inputs or supplies and available for VAT credit should be debited to a separate account say VAT Credit Receivable Inputs Account. Any VAT charged incurred is not included in the profit and loss account.