Beautiful Warranty Expense Income Statement

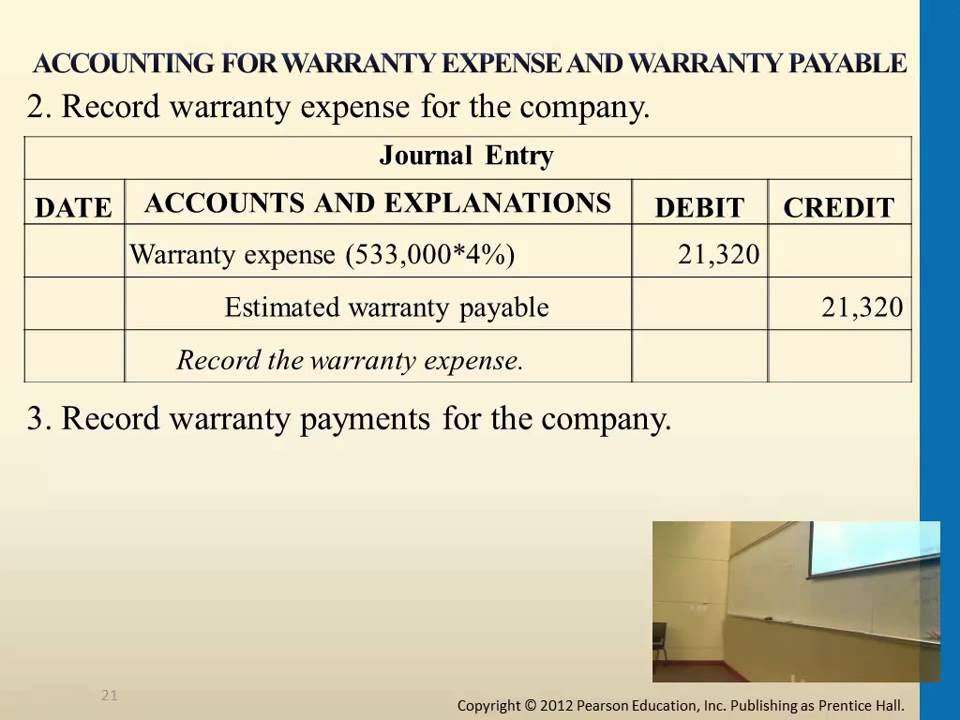

Extended warranty cost 600 Term 30 months Monthly expense 60030 20 The journal entry to post the expense.

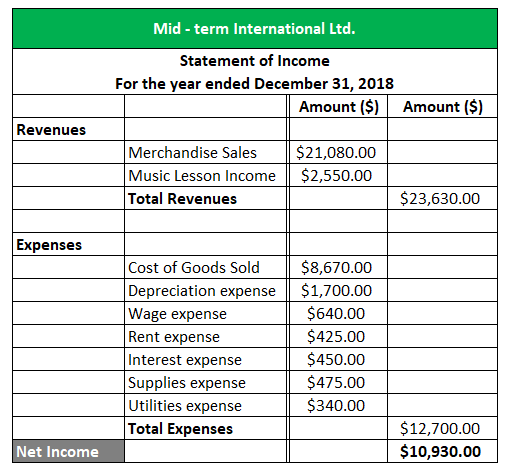

Warranty expense income statement. First calculate the number of units the company believes will need to be replaced under warranty. If the amount of warranty expense recorded is significant expect the companys auditors to investigate it. The total amount associated is limited to the warranty period permitted by the business.

Units sold the percentage that will be replaced within the warranty period and the cost of replacement. These two conditions are part of the FASBs Statement of Financial Accounting Standards No. Thus the income statement is impacted by the full amount of warranty expense when a sale is recorded even if there are no warranty claims in that period.

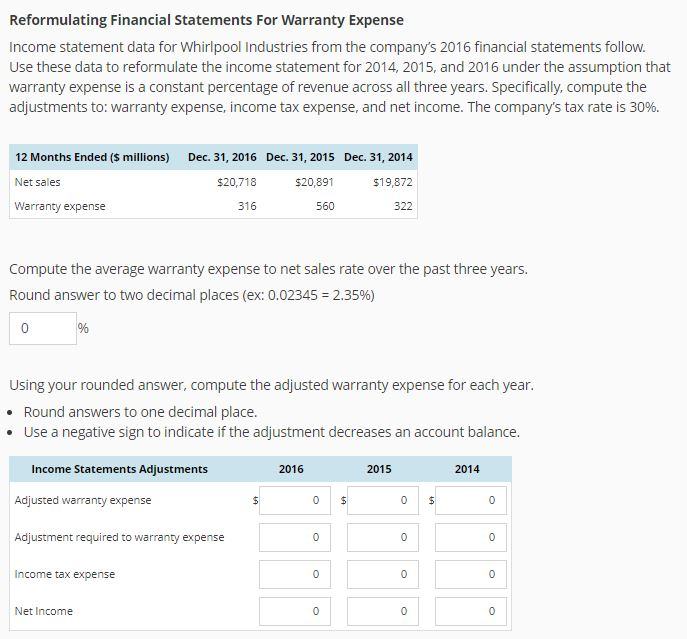

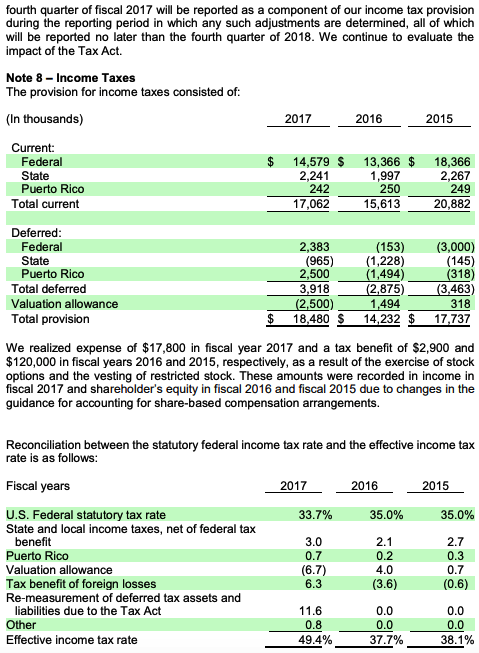

Once this period has lapsed businesses no longer incur a warranty liability. Reformulating Financial Statements For Warranty Expense Income statement data for Whirlpool Industries from the companys 2016 financial statements follow. Because warranty estimates are forecasts that are based on the best available informationmostly historical claims experienceclaims costs may differ from amounts provided.

5 Accounting for Contingencies. It is expected that 3 of the units will be defective and that repair costs will average 50 per unit. Use these data to reformulate the income statement for 2014 2015 and 2016 under the assumption that warranty expense is a constant percentage of revenue across all three years.

What amount should Marin Company report as Warranty Expense in its 2011 income statement. A product warranty liability and warranty expense should be recorded at the time the product is sold if it is probable that customers will be making claims under the warranty and the amount can be estimated. Reformulating Financial Statements For Warranty Expense.

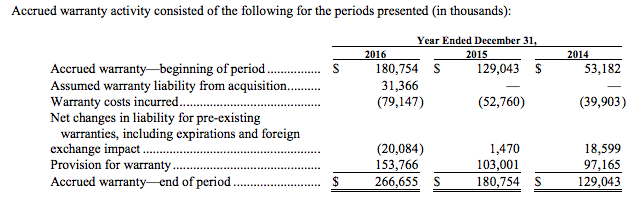

Each month the amount utilized is transferred from the deferred expense account to the income statement. Basically what FIN 45 said in regards to warranty was that beginning with either their late 2002 or early 2003 financial statements all companies that use the accrual method to finance their payouts must begin to disclose the beginning and. When claims appear in subsequent accounting periods the costs incurred will reduce the warranty liability account.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)