Outrageous Income Statement For Manufacturing Company Different Forms Of Balance Sheet

Items of value the company owns.

Income statement for manufacturing company different forms of balance sheet. The portion of assets the company owns outright with no debt. Along with the balance sheet and the statement of cash flows the income statement is one of the big three financial reports. The balance sheet or statement of financial position of a manufacturing company is similar to that of a merchandising company.

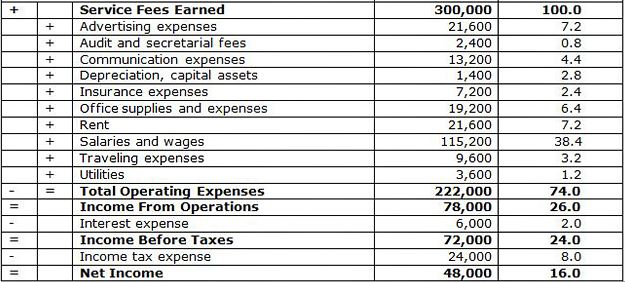

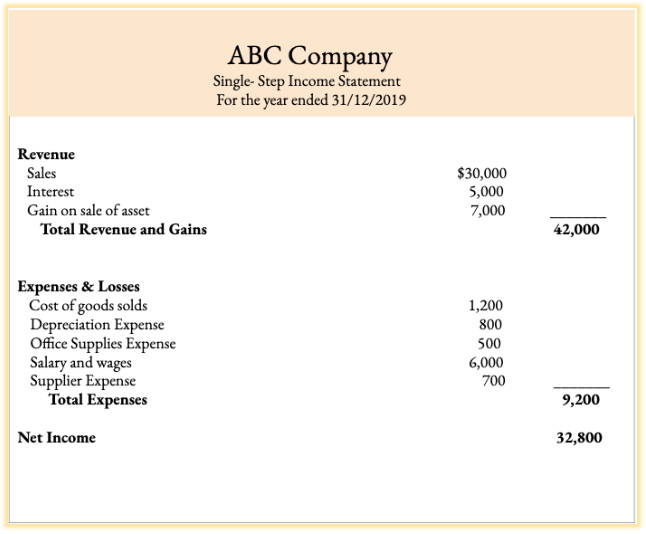

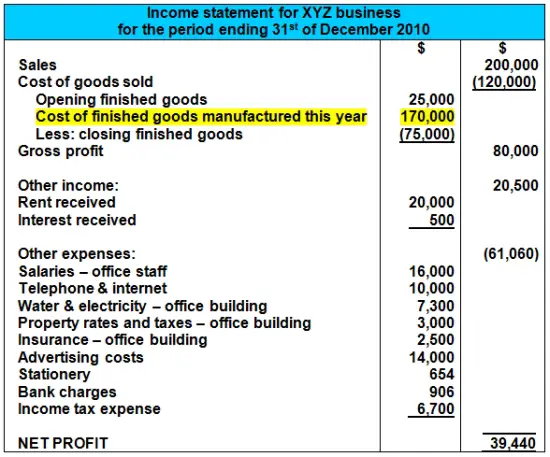

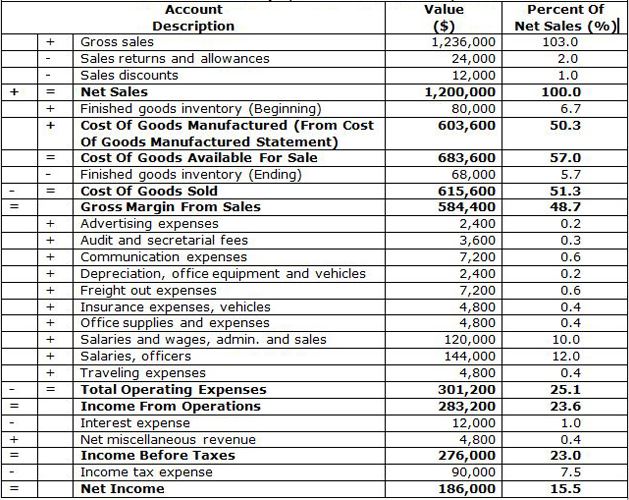

Money earned from sales plus. While presenting the Statement of Income various entities present different types profit namely gross profit operating profit EBITDA Profit before tax Profit after tax. An income statement summarizes your revenue and costs and shows your net profit in your business plan.

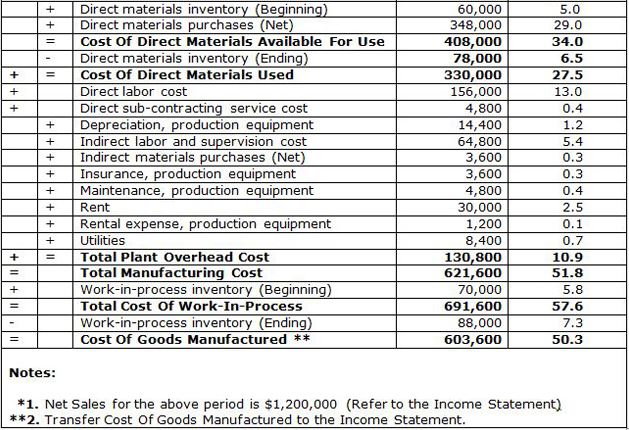

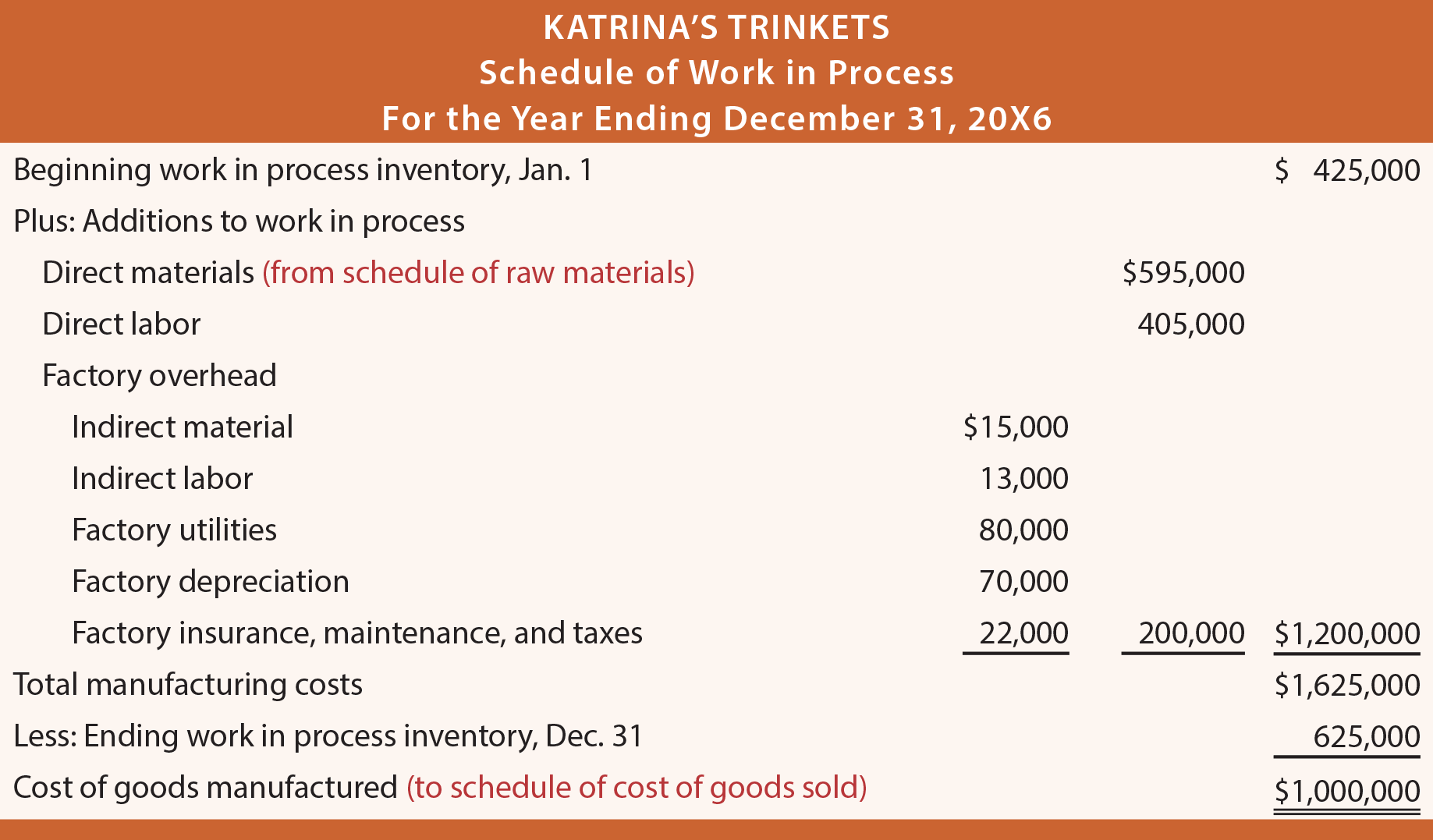

Presenting the fundamentals of financial statements for a manufacturing business. PPE Depreciation and Capex. On the balance sheet it feeds into retained earnings and on the cash flow statement it is the starting point for the cash from operations section.

The key differences between the two reports include. Inventories include raw material which are used for the production process work-in-progress which are yet to be converted to finished goods and finished goods which are ready to be sold to customers. Most businesses can be classified into one or more of these three categories.

Cost of goods sold Opening stock Purchases Closing stock. Gross Profit is normally presented by trading entities. That is just one difference so lets see what else makes these fundamental reports different.

Income statement statement of retained earnings balance sheet and statement of cash flows. However the inventory accounts differ between two types of companies. The income statement reports revenue expenses and profit or loss while the balance sheet reports assets liabilities and shareholder equity.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)