Perfect Which Is More Important Balance Sheet Or Income Statement

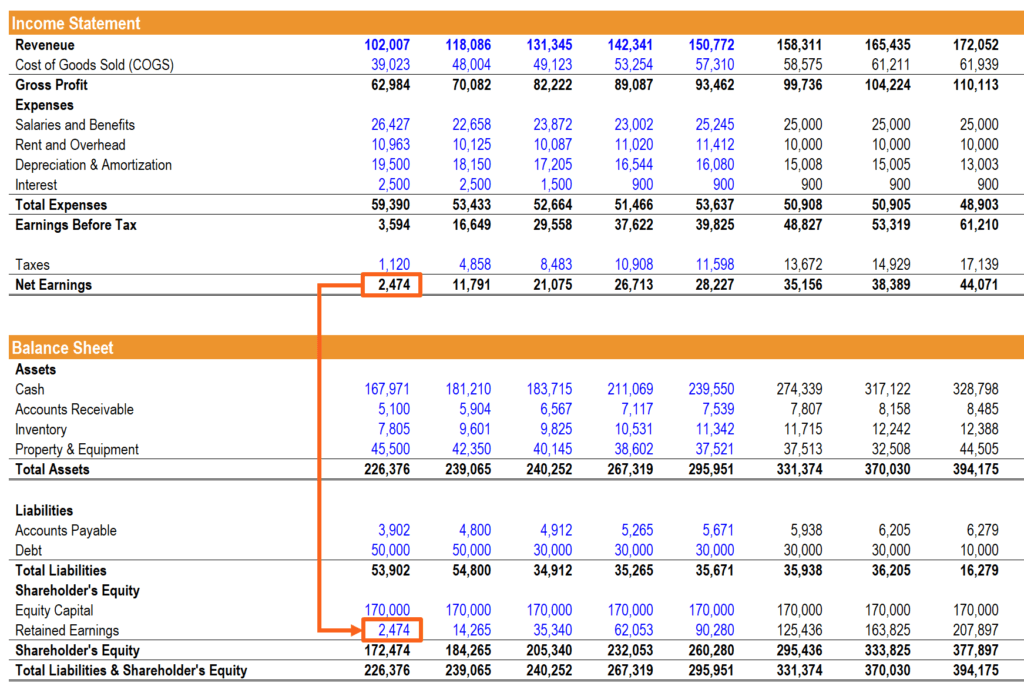

It displays this information in terms of your companys assets liabilities.

Which is more important balance sheet or income statement. I wouldnt make too many exceptions but sometimes a Priced based metric thats not ideal but also not ridiculous can be allowed if the other Price based metrics are really really good. The balance sheet only shows historical numbers. This discrimination imposed on the income statement is so serious that some investors are encouraged to ignore the income statement as a whole.

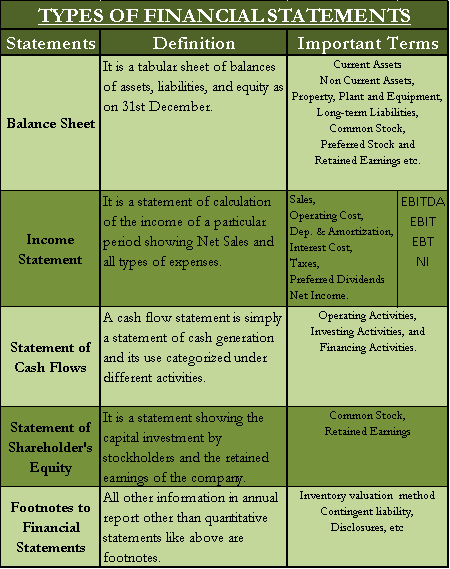

Below is a list of five reasons that the Balance Sheet is the most important report you should be looking at. The Income Statement Profit and Loss Report and the Balance Sheet. The income statement gives your company a picture of what the business performance has been during a given period while the balance sheet gives you a snapshot of the companys assets and liabilities at a specific point in time.

For example while the balance sheet will provide users with information about a businesss financial health at a specific point in time it can also calculate a businesss debtequity ratio. The income statement is the most important document. A balance sheet is one of several major financial statements you can use to track spending and earnings.

If your Balance Sheet is clean then the financials are clean. Cash flow however uses only cash transactions to determine how and where a company is using cash. In the last ten years or so this has changed so much so that readers and users are advised to lend substantially more credence to the balance sheet than the income statement.

Balance sheets are important for many reasons but the most common ones are. These numbers and entries might or might not be relevant. A balance sheet lists assets and liabilities of the organization as of a.

Depending on the information you require for decision-making purposes youll find either the balance sheet or the income statement more useful. Like with all of the simple balance sheet and income statement metrics Ive discussed here sometimes a lower Priced based metric can cancel out a higher one as long as there is balance. The five most common types of financial statements are the balance sheet income statement statement of cash flow statement of changes in equity and statement of financial position.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)