Fun Contoh Post Closing Trial Balance

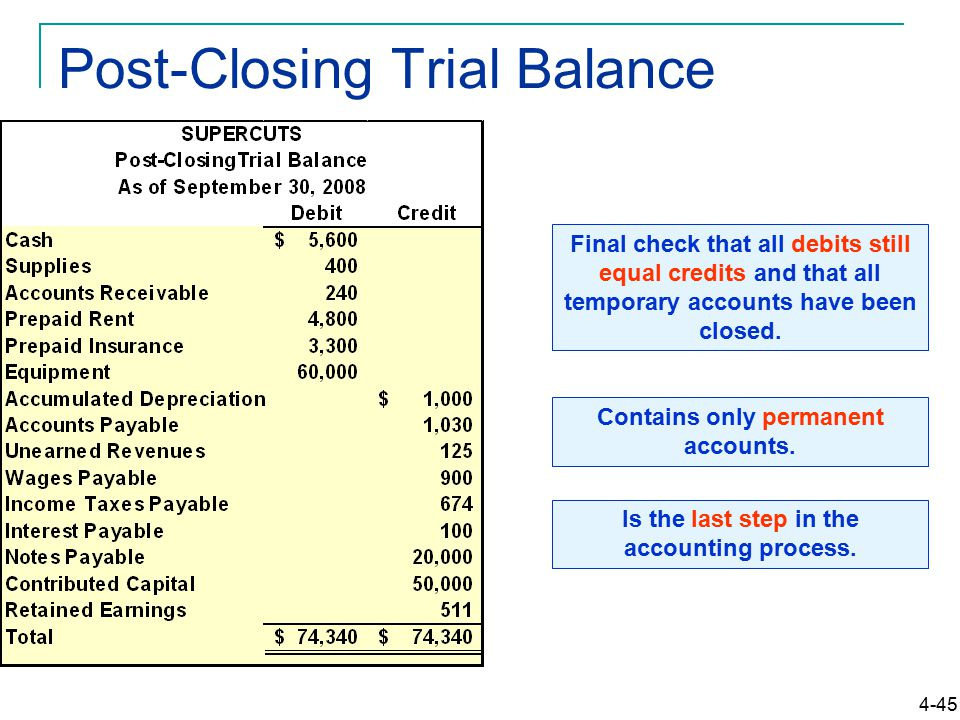

Post-Closing Trial Balance.

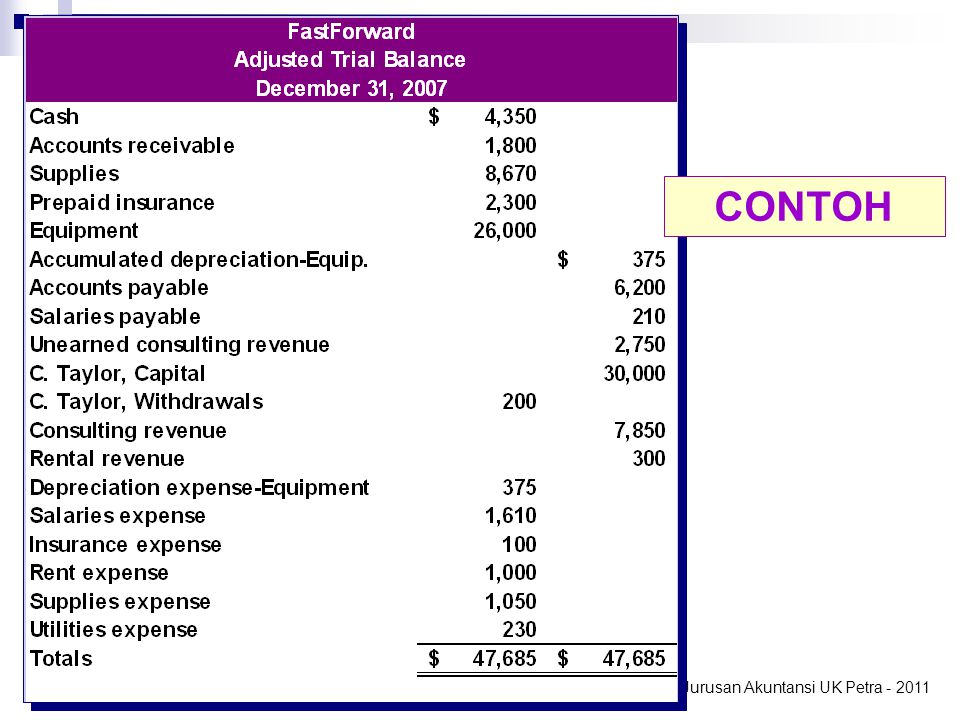

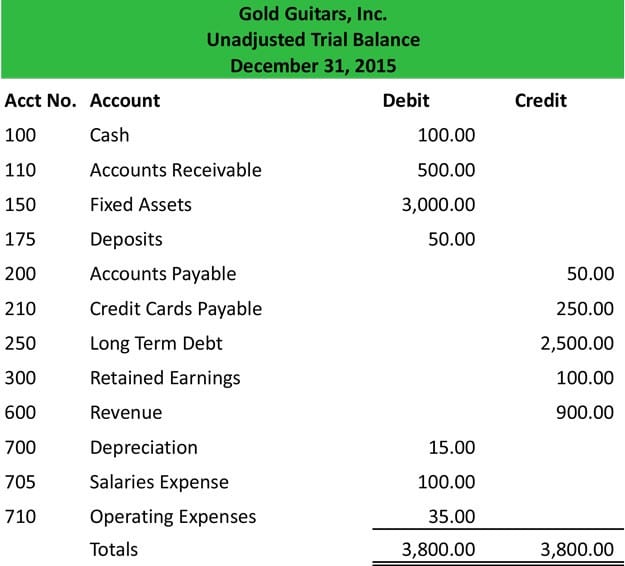

Contoh post closing trial balance. Since the closing entries transfer the balances of temporary accounts ie. Ad Over 2000 Essential Templates to Start Organize Manage Grow Your Business in 1 Place. The post-closing trial balance is the final step in the accounting cycle Running a trial balance is a must for anyone manually recording financial transactions since it helps to make sure that.

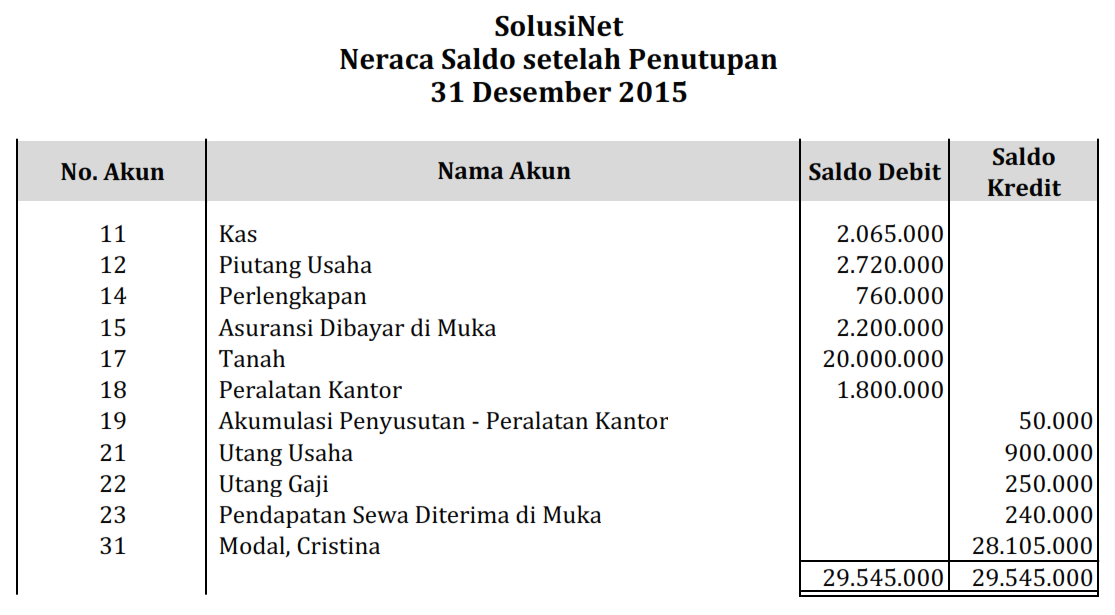

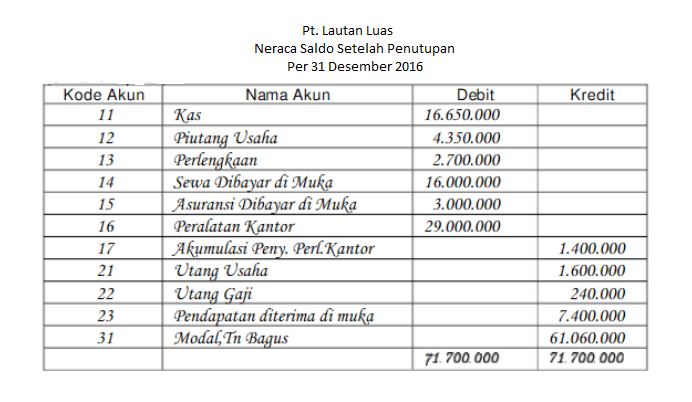

Purpose of preparing post-closing trial balance is to ensure that. Neraca Saldo setelah Penutupan Post Closing Trial Balance Dengan selesainya pembuatan jurnal penutup dan melakukan penutupan buku besar seperti tersebut di atas maka tahapan berikutnya adalah membuat neraca saldo setelah penutupan. It is a summary report listing all the ledger accounts and their balances at the end of an accounting period.

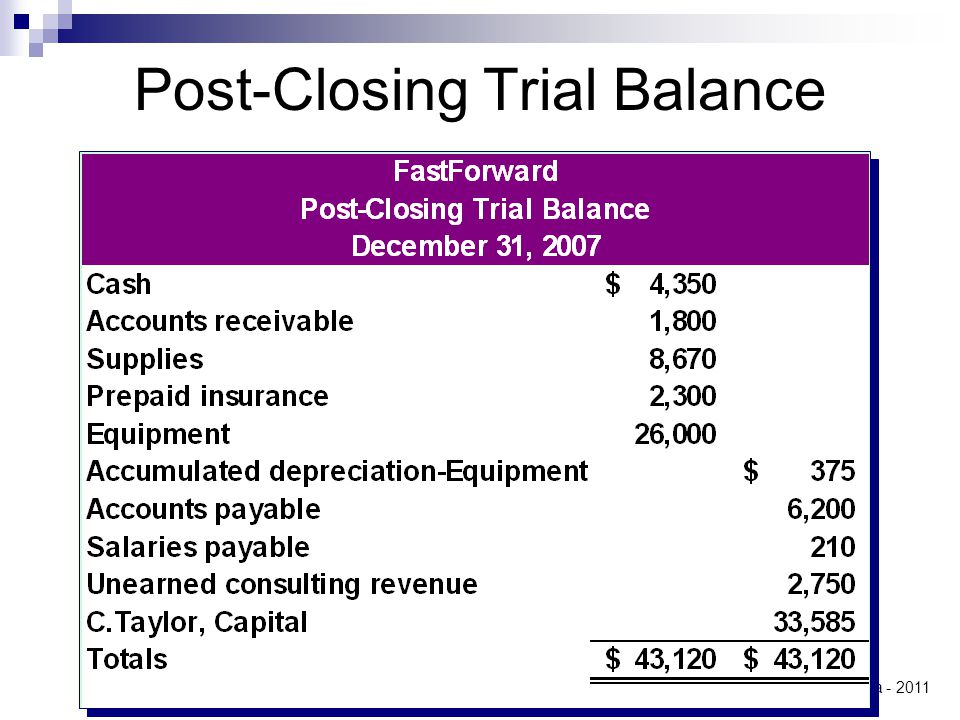

The post-closing trial balance for ABC Consulting Inc. The post-closing trial balance report lists down all the individual accounts after accounting for the closing entries. A post-closing trial balance is an accuracy check and it ensures that the totals of debit balances and credit balances are equal at the end of the closing period.

A post-closing trial balance is a list of balances of ledger accounts prepared after closing entries have been passed and posted to the ledger accounts. The post-closing trial balance also known as after-closing trial balance is the last step of accounting cycle and is prepared after making and posting all necessary closing entries to relevant ledger accounts. Prosedur ini merupakan langkah terakhir dalam satu periode.

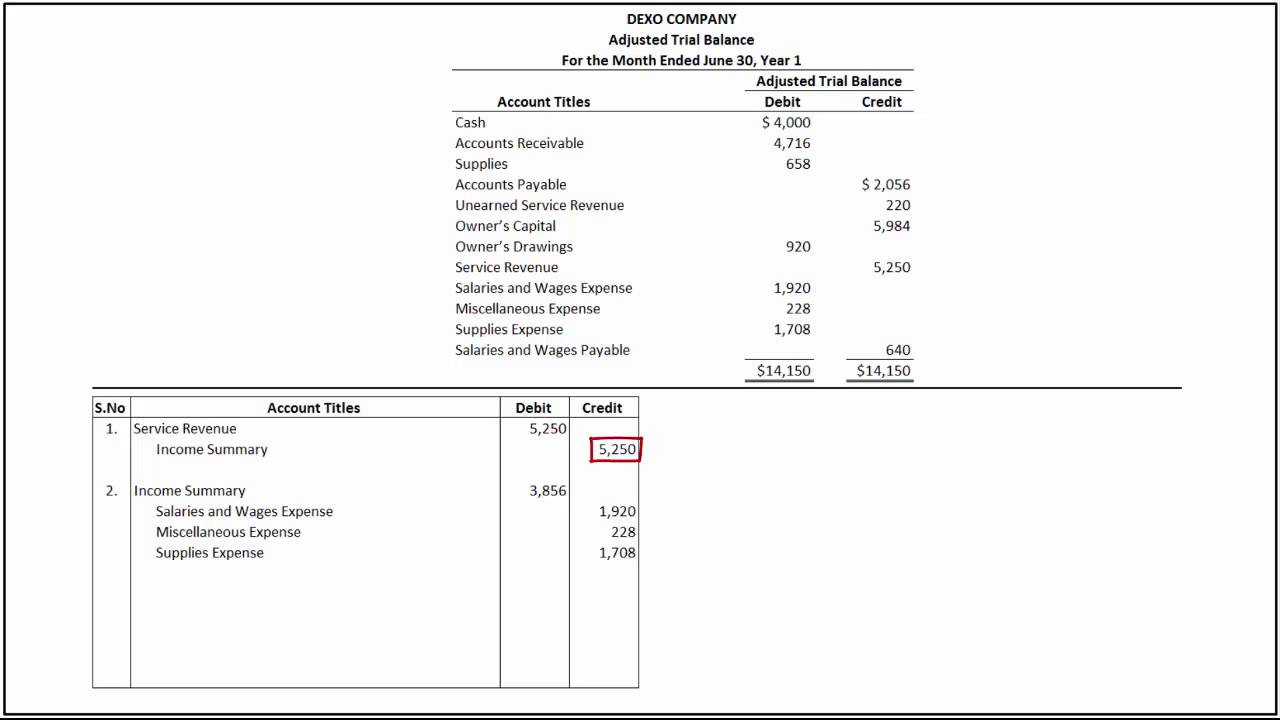

The screenshot presents the post-closing trial balance which includes only permanent accounts from the general ledger. Learn the four closing entries and how to prepare a post closing trial balance. The post-closing trial balance will include only the permanentreal accounts which are assets liabilities and equity.

Download Template Fill in the Blanks Job Done. At this point in the accounting cycle all the temporary accounts have been closed and zeroed out to permanent accounts. Expense revenue gain dividend and withdrawal accounts to the retained earnings account.