Unique Deloitte Financial Statements Classified Balance Sheet Example

As illustrated in Example 4 see ASC 280-10-55-54 if the CODM reviews inventory by segment in total but does not regularly review information about inventory for each component by segment an entity would be required to disclose only total inventory by segment in its interim financial statements.

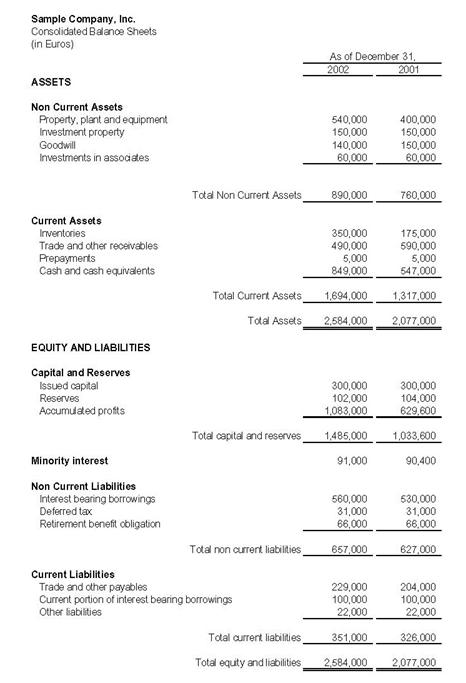

Deloitte financial statements classified balance sheet example. Illustrative in nature The sample disclosures in this set of illustrative financial statements should not be considered to be. The full audited financial statements of Deloitte LLP for the year ended 31 May 2011 were approved by the Board on 8 August 2011. When needed interim financial statements must include 1 an interim balance sheet as of the end of the most recent interim period after the latest fiscal year-end see the Age of Financial Statements section and 2 statements of comprehensive income cash flows and changes in shareholders equity for the year-to-date period from the.

The UK Oversight Board following a review of its profit and cash flow plans has concluded that at the time of approving these financial statements Deloitte LLP has adequate resources to continue operations at least twelve months from the date of this reportfor. As at 31 May 2008 2008 2007 Note m m. Total members interests before annuities payable from future profits.

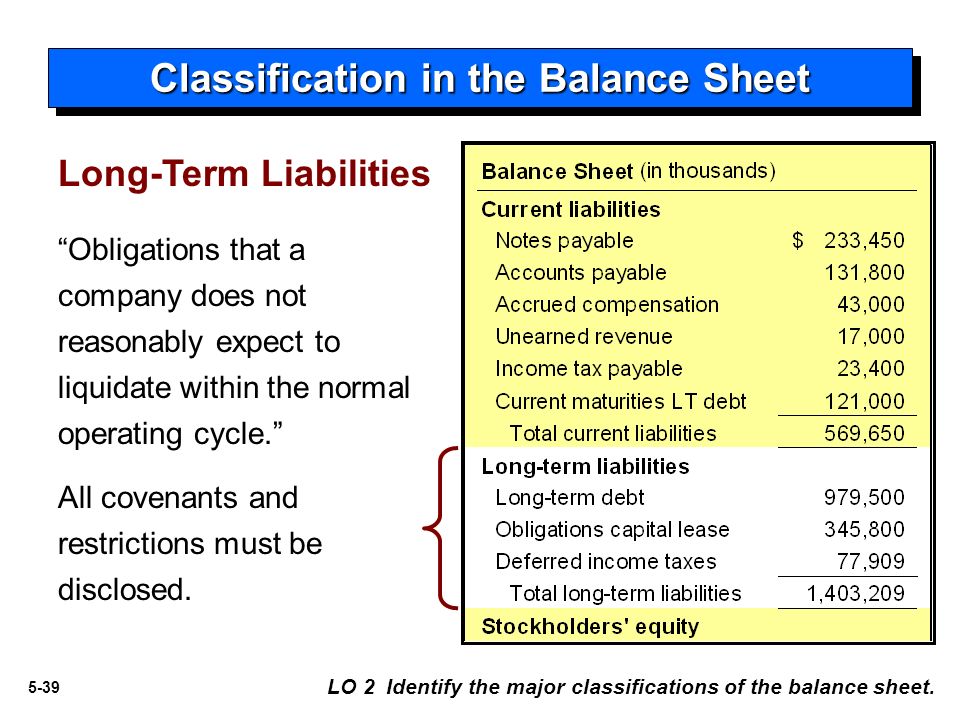

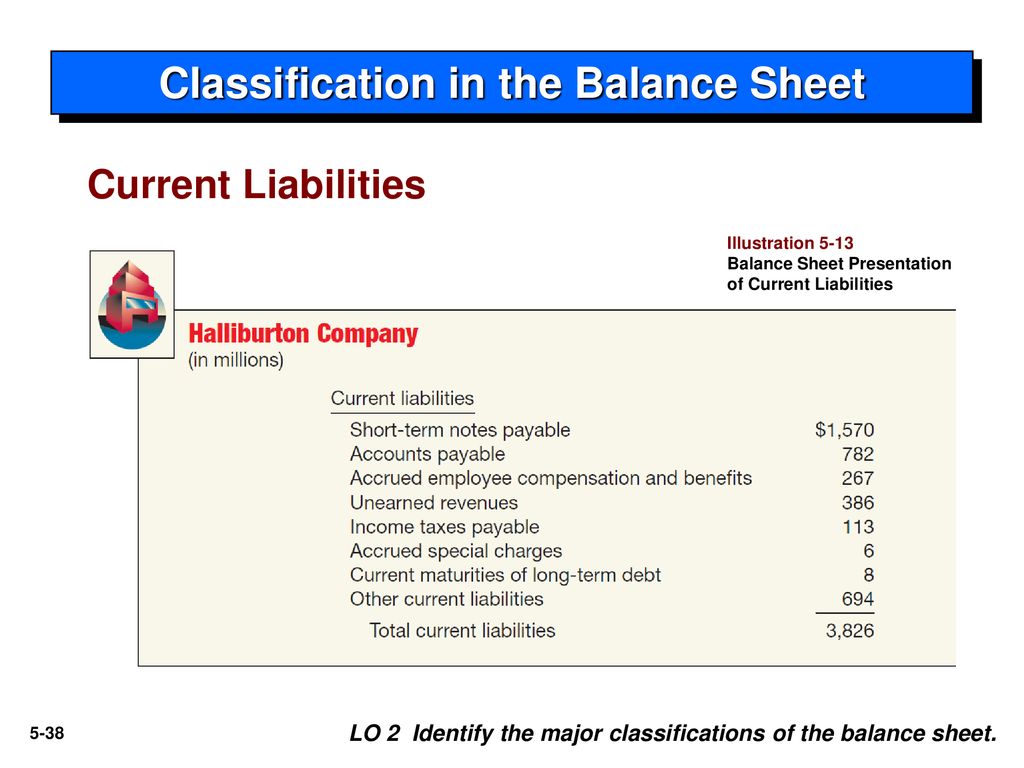

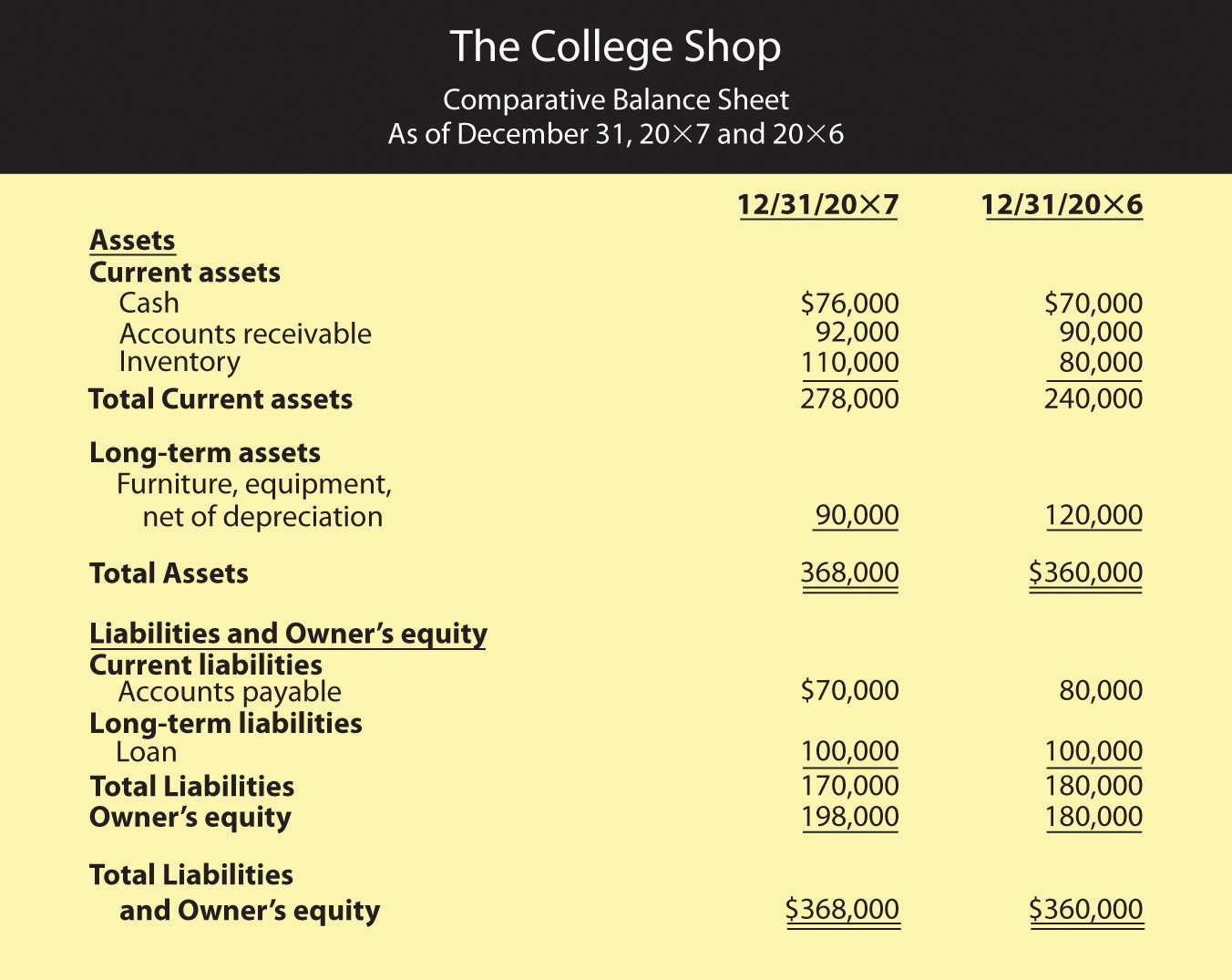

The guidance is intended to address concerns related to off-balance sheet financing as it brings most leases onto the balance sheets of lessees. If a calendar year end registrant filed a registration statement containing a pro forma balance sheet as of June 30 1999 giving effect to an acquisition consummated on September 15 1999 and then made an acquisition on November 30 1999 the asset and investment test would be based on a pro forma balance sheet as of December 31. However all entities were affected by the standards new and modified quantitative and qualitative disclosure.

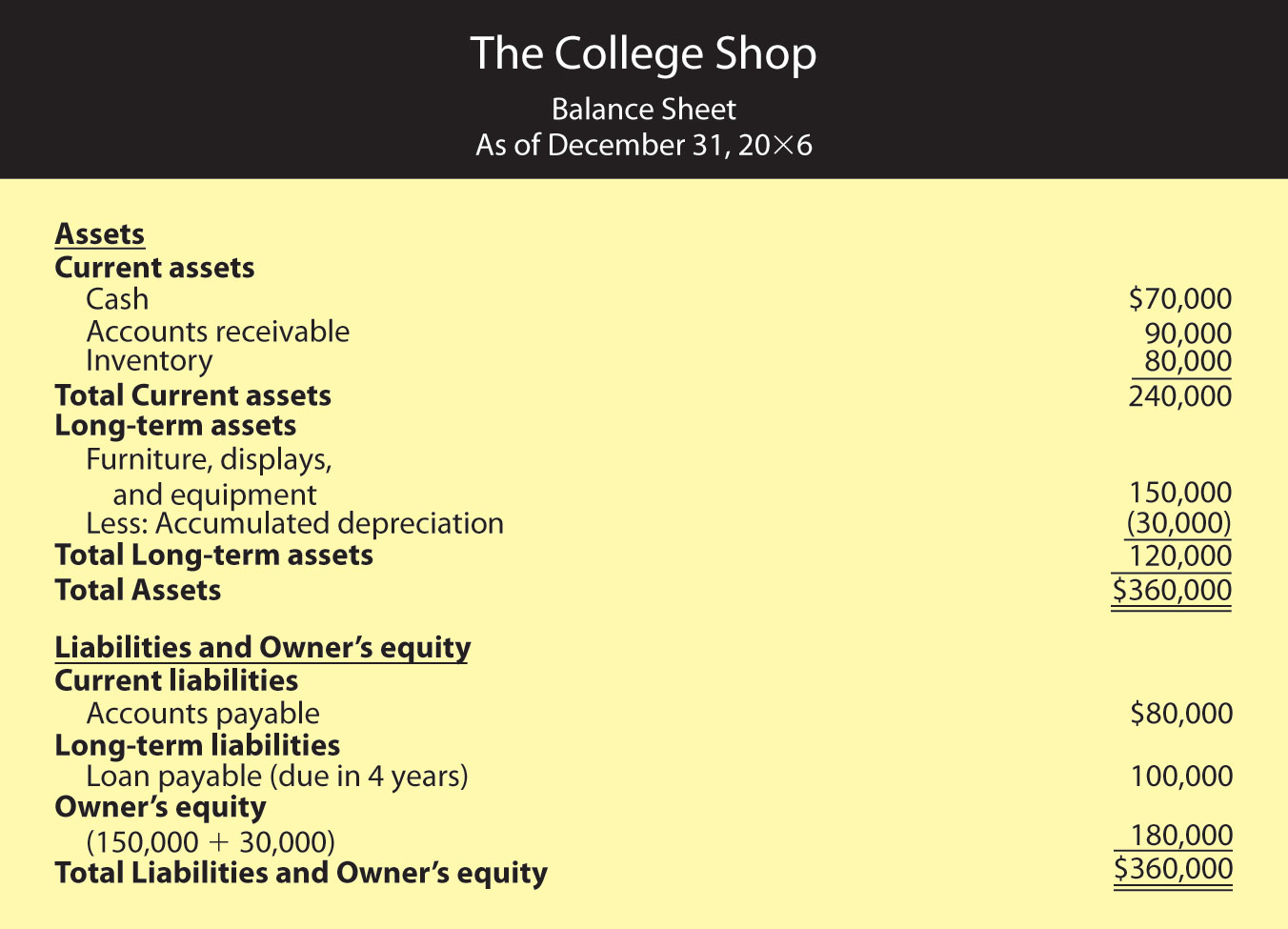

Deloitte ie ienes Aounting and inania Reporting pdate. 461 Presentation on a Classified Balance Sheet 75. GAAP along with quantitative reconciliations of net income and material balance sheet items does Item 17 of Form 20-F require other disclosures in addition to those prescribed by the standards and practices which comprise the.

Get a head start on drafting financial statements. Calendar-year-end public business entities adopted the FASBs new revenue standard ASC 6061 in the first quarter of 20182 While some companies made wholesale changes to their financial statements the effect of the new requirements was less significant for others. These model financial statements in conjunction with the Australian financial reporting guide contain complete illustrative disclosures for companies preparing general purpose financial statements in full compliance with Australian Accounting Standards as at 30 June 2020.

From a lessor perspective accounting for lease revenue will essentially be unchanged under the new standard and most real estate leases will continue to be classified as operating leases. An entity should recognize the entire loan amount as a financial liability if a classified balance sheet is presented the liability will be classified as current or noncurrent under ASC 470-10-45 with interest accrued and expensed over the term of the loan. The financial statements on pages 36 to 68 were approved by the Board on 21 July 2008.