Awesome Ifrs For Smes Standard

The International Financial Reporting Standard for Small and Medium-sized Entities IFRS for SMEs is set out in Sections 135 and Appendices AB.

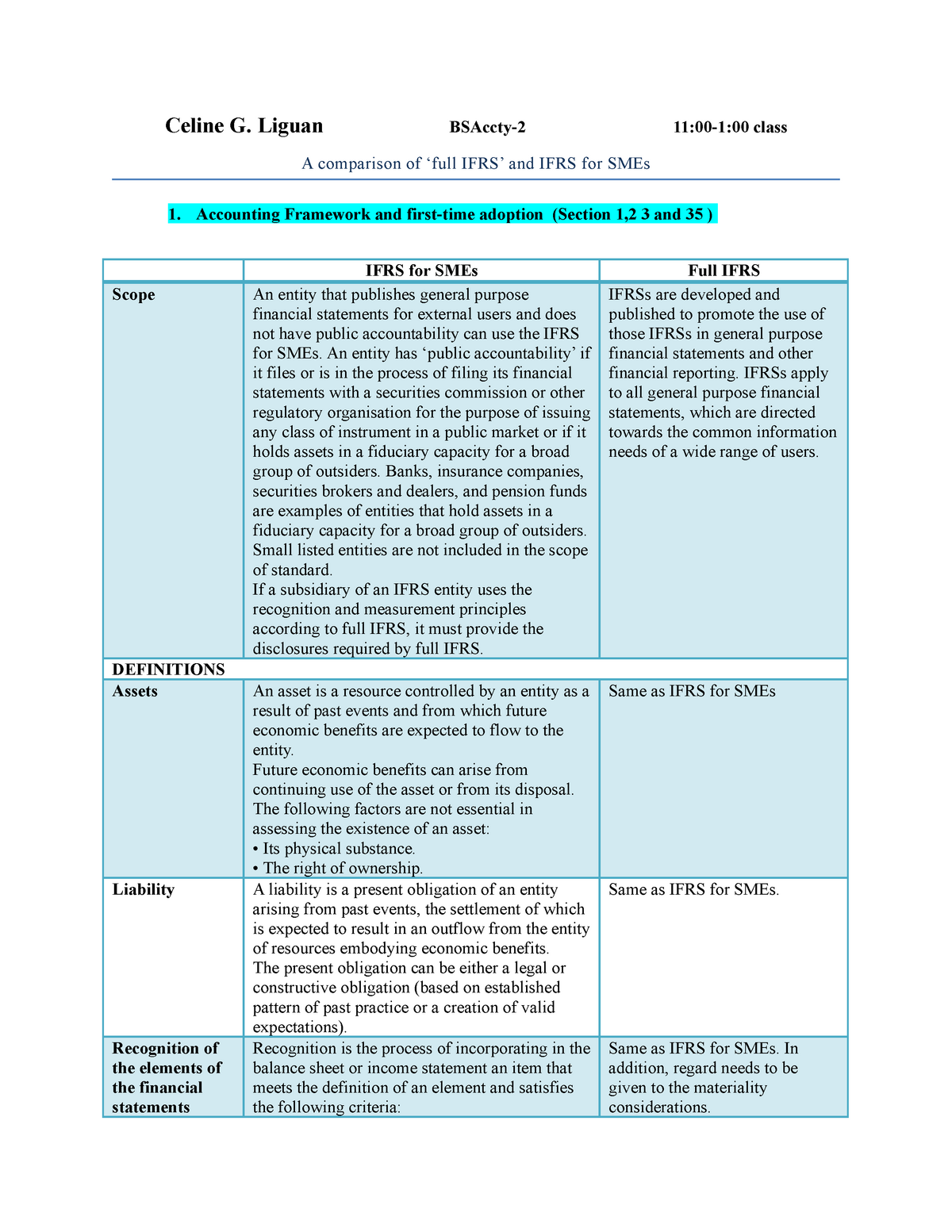

Ifrs for smes standard. Consequently the requirements of paragraph 214C apply to the assessment of whether an investment property can be measured reliably at fair value without undue cost or. Learn the key accounting principles to be applied to the IFRS for SMEs Standard that can be applied by eligible entities in place of full IFRS Standards. It is a matter for authorities in each territory to decide which entities are permitted or even required to apply IFRS for SMEs.

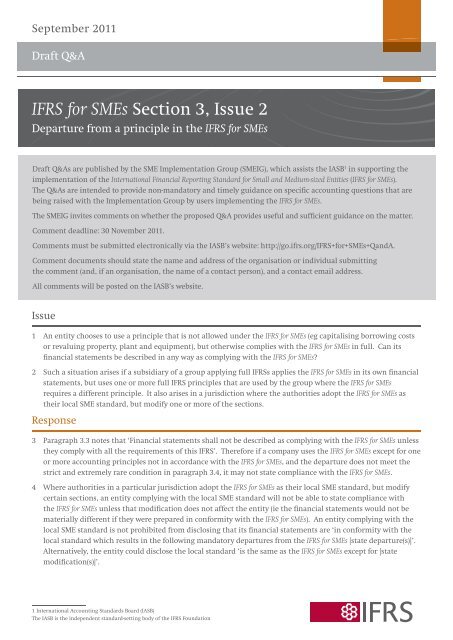

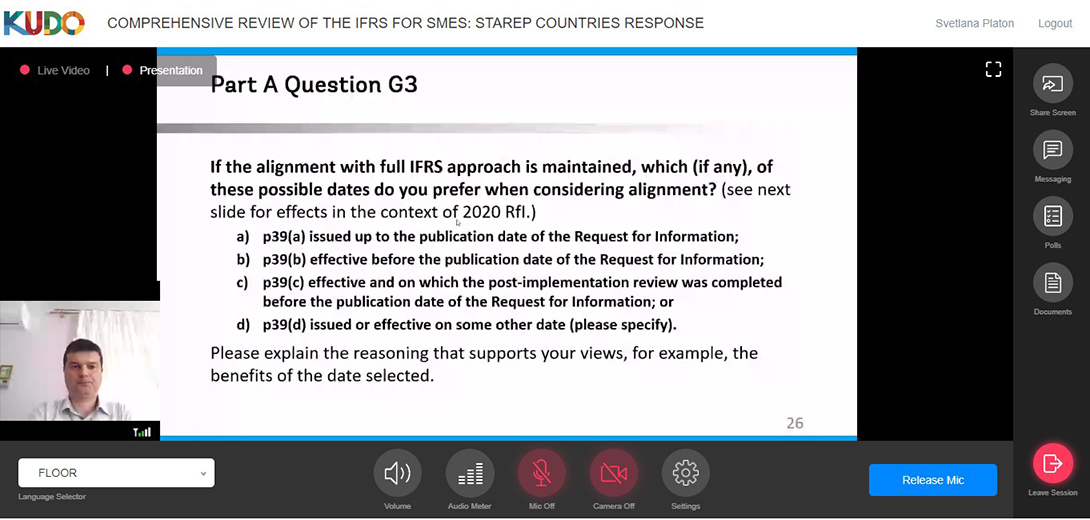

In July 2009 the International Accounting Standards Board the Board issued the IFRS for SMEs Standard the SMEs Standard. IFRS for SMEs Standard would originate only from direct input about the needs of users of SMEs financial statements and preparers resources and without any reference to developments in full IFRS Standards. BC2 The IFRS for SMEs Standard defines a financial instrument as a contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of.

Any differences between the IFRS for SMEs Standard and full IFRS Standards would be expected to widen over time. Although the IFRS for SMEs includes guidance on fair value measurement this does not reflect the revised definition of fair value in IFRS 13 Fair Value Measurement. One aim of the IFRS for SMEs is to provide a standard for entities in countries that have no national GAAP.

IFRS Standards are permitted but not required for domestic public companies IFRS Standards are required or permitted for listings by foreign companies The IFRS for SMEs Standard is required or permitted The IFRS for SMEs Standard is under consideration. An entity has public accountability if it files. The SMEIG concluded that View 2 is the required accounting under the IFRS for SMEs Standard.

Terms defined in the Glossary are in bold type the first time they appear in each section as appropriate. Since the IFRS for SMEs is intended to apply to SMEs these differences are. The IFRS Foundations logo and the IFRS for SMEs logo the IASB logo the Hexagon Device eIFRS IAS IASB IFRIC IFRS IFRS for SMEs IFRS Foundation International Accounting Standards International Financial Reporting Standards NIIF and SIC are registered trade marks of the IFRS Foundation further details of which are available from the IFRS.

There are as a result some significant differences between the IFRS for SMEs and full IFRSs. The IFRS for SMEs Standard is intended for entities that are not publicly accountable and publish general-purpose financial statements for external users. The IFRS for SMEs Standard.