Top Notch Journal Entry For Investment In Subsidiary

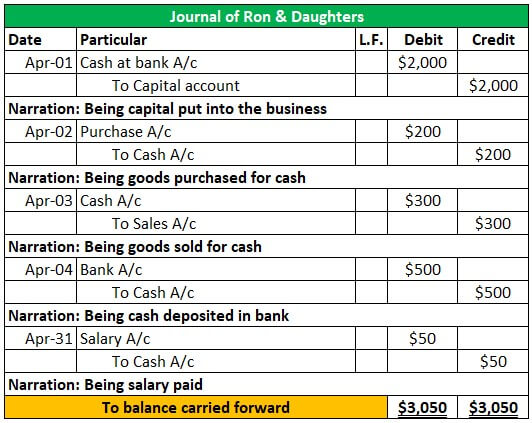

Investment in ABC debit 300000 Cash credit 300000.

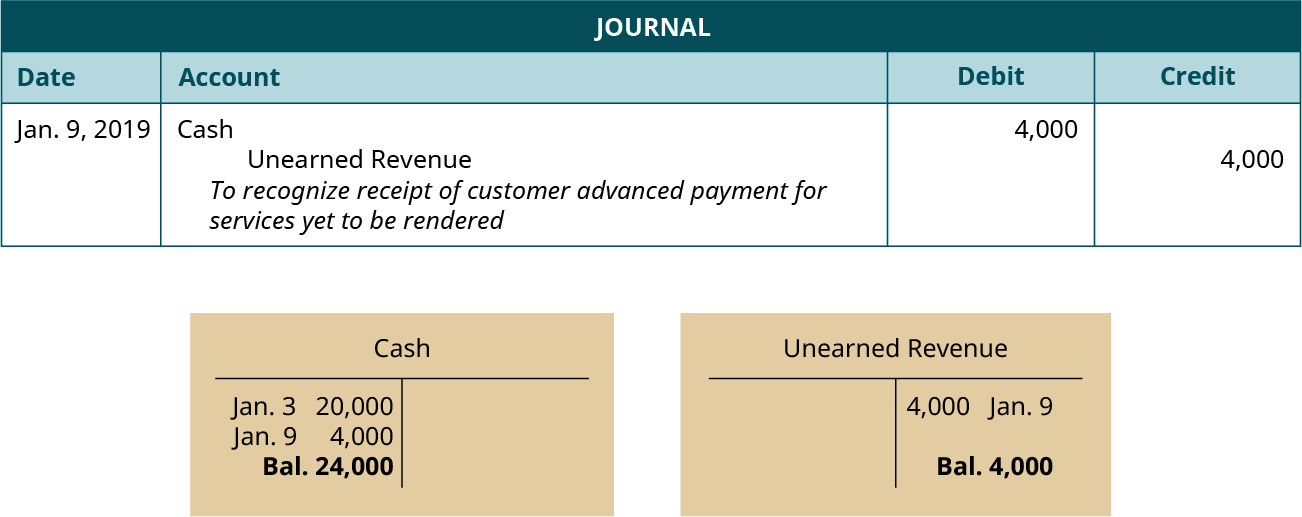

Journal entry for investment in subsidiary. Instead the consolidated statement of financial position will contain only assets and liabilities of a parent. For example if the parent bought 50000 worth of a subsidiarys stock it would debit Intercorporate Investment for 50000 to reflect the new asset and credit cash for 50000 to reflect the cash outflow. The initial journal entry under the equity method is to record the outflow of cash and to add the investment as a noncurrent asset on its balance sheet as follows.

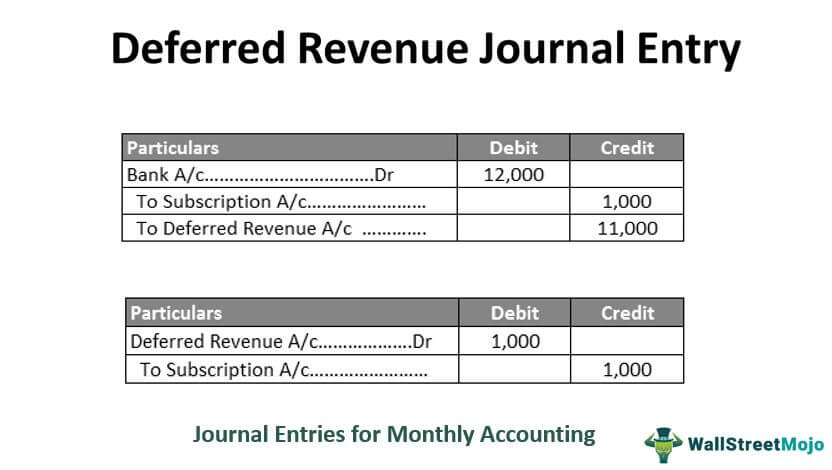

The first of the equity method journal entries to be recorded is the initial cost of the investment of 220000. Debit the account called impaired goodwill expense by the amount of the write-off in a journal entry in your accounting records. Journal entries recorded by PT Tomika.

To do this debit Intercorporate Investment and credit Cash. Subsequent to this the subsidiary company prepared accounts to 30 April 2016 which showed all assetsliabilities had been stripped out. And no there wont be neither goodwill nor investment in a subsidiary.

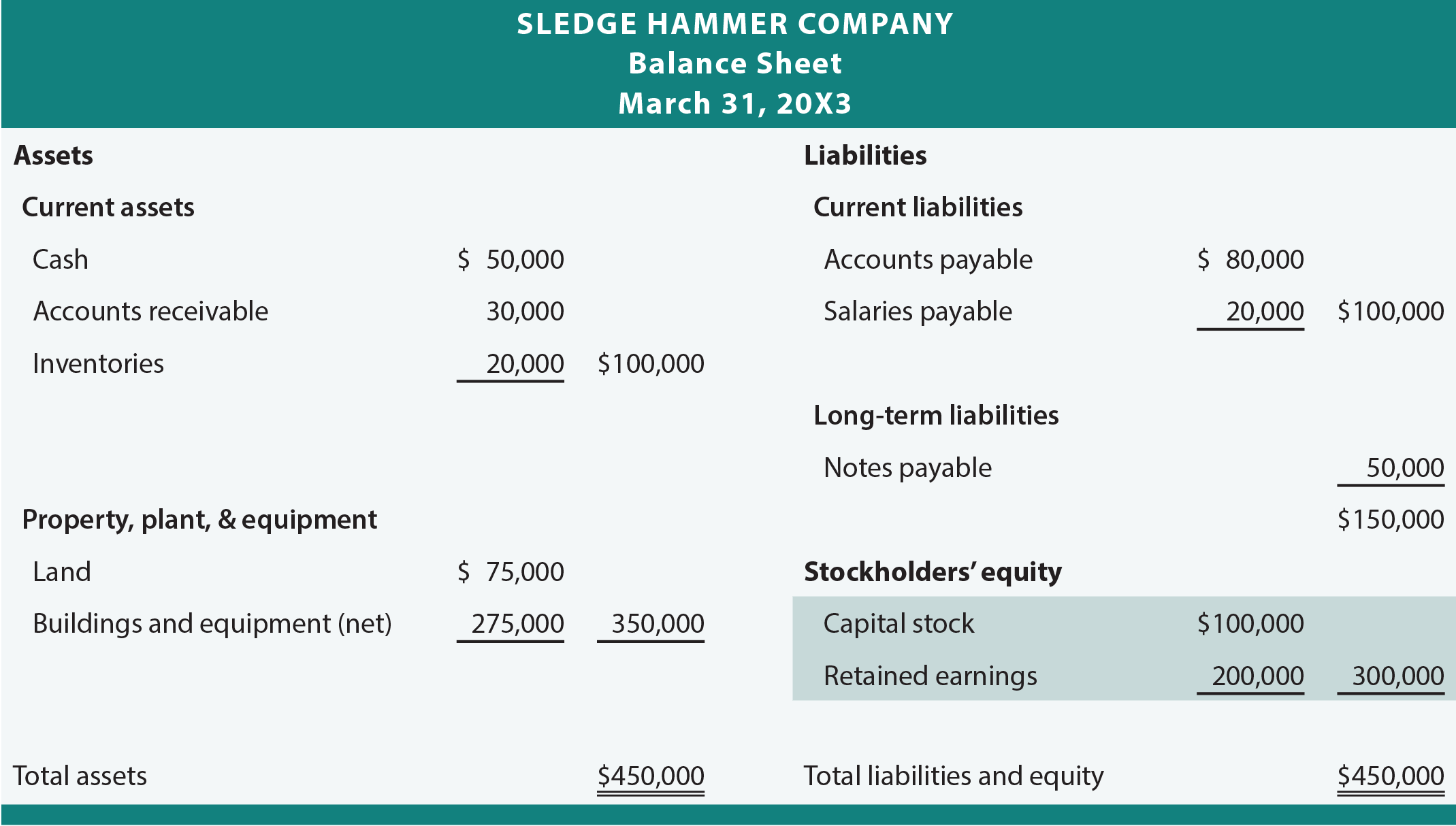

This is very easy to perform because you will simply not make any aggregation of assets and liabilities of a parent and of a subsidiary. Consolidation Entries for Wholly Owned Subsidiary a. Journal Entry for Investment in Subsidiary Suppose Book Ltd acquires 60 shares in Paper Ltd in the month of April 201 against consideration of 5000000.

The investment is debited and cash or bank is credited as case may be. Investment in Subsidiary Journal Entry. The investment of parent company made in subsidiary is recorded at cost.

See Page 1. B Journal Entries 713 Debit Credit Impaired goodwill expense xxx Goodwill xxx Increased Investment in Subsidiary If the acquiring entity does not initially purchase all outstanding shares of an acquiree but later purchases additional shares then the additional payment is recorded as an increase in the investment in the subsidiary. Journal Entry for investment in subsidiary.