Nice Increase In Common Stock Cash Flow

How issuing common stock can increase cash flows Although issuing common stock often increases cash flows it.

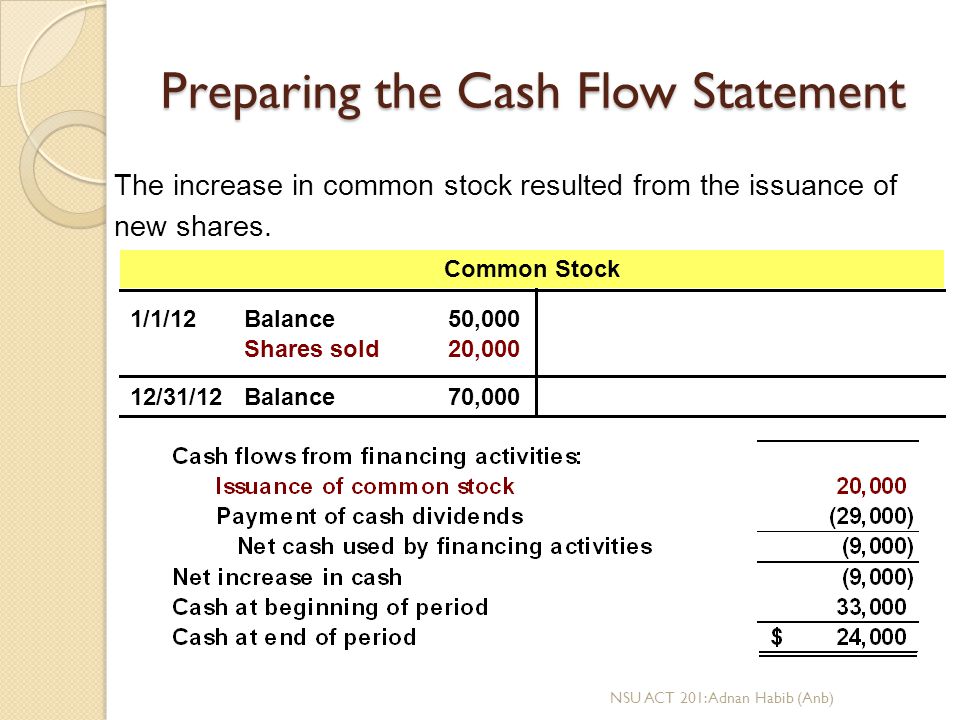

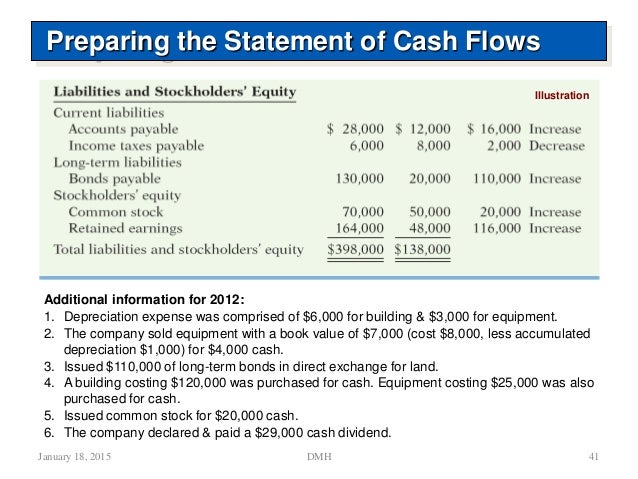

Increase in common stock cash flow. During stock splits for instance a company issues new shares that it gives to current shareholders. What is the cash flow from financing activities. An increase in cash flows from operating activities.

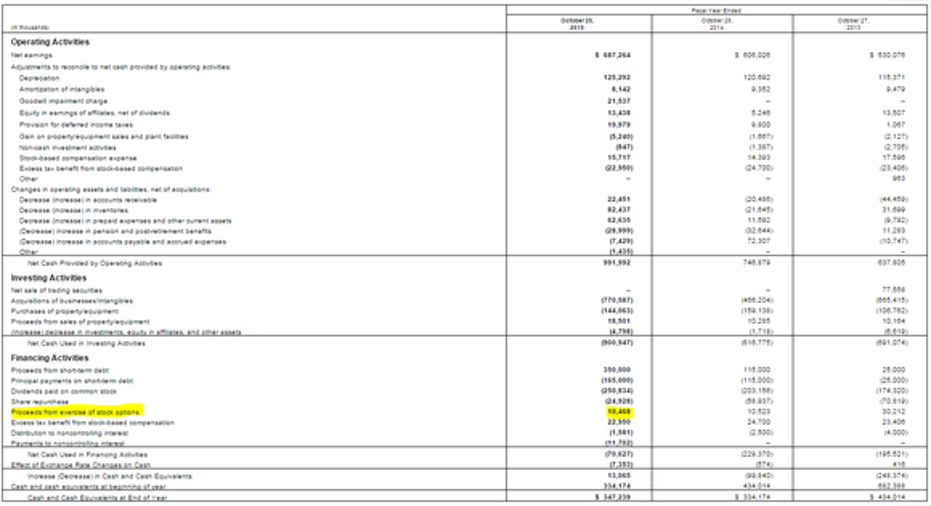

Likewise what is the purpose of the statement of changes in cash flow. Although issuing common stock often increases cash flows it doesnt always. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets.

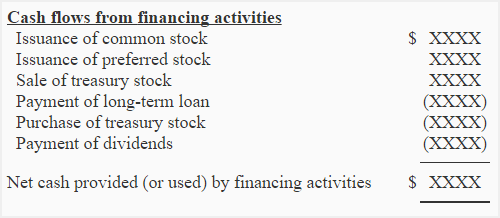

This item would not be recorded on the statement of cash flows. A cash flow from financing activities. In the Statement of Cash Flows an increase in Common stock would be recorded as.

Cash forms a fourth section at the bottom of the statement in which the beginning cash balance is added to the total of the three sections to determine the ending balance for cash. In the cash flow statement a cash inflow of 20000 is reported in the financing. In 2019 the company decides to sell all its treasury stock and receives an amount of 20000 against it.

A cash flow from operating activities. The largest line items in the cash flow from financing. To find stocks that have seen increasing cash flow over time we ran the screen for those whose cash flow in the latest reported quarter was at least equal to or greater than the 5-year average.

The increase in capital for the company raised by selling additional shares of stock can finance additional company growth. To sell to or pay as dividends to existing shareholders. The largest line items in the cash flow from financing section are dividends paid repurchase of common stock and proceeds from issuance of debt.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)