Supreme Reconciliation Of Absorption And Variable Costing

Read more whereas Absorption costing.

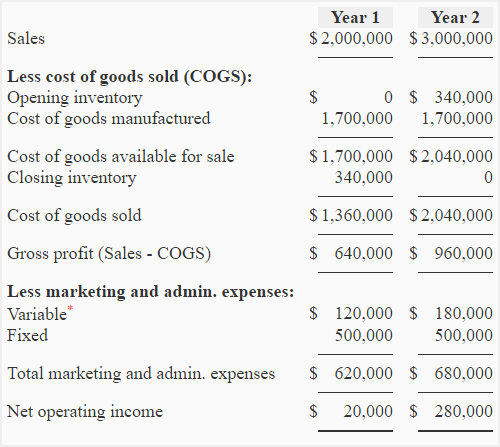

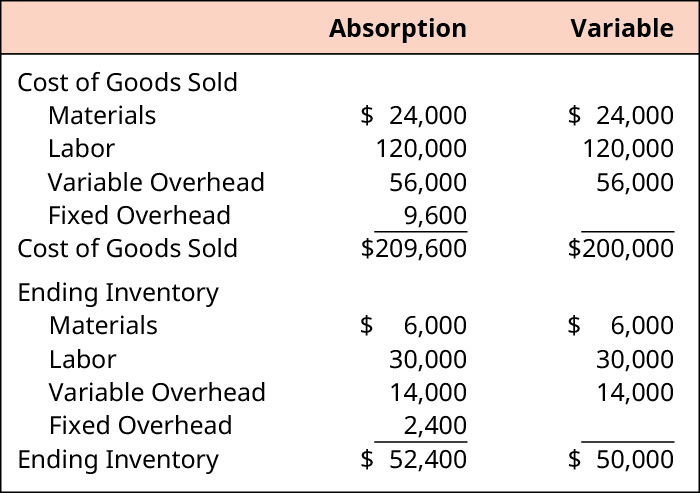

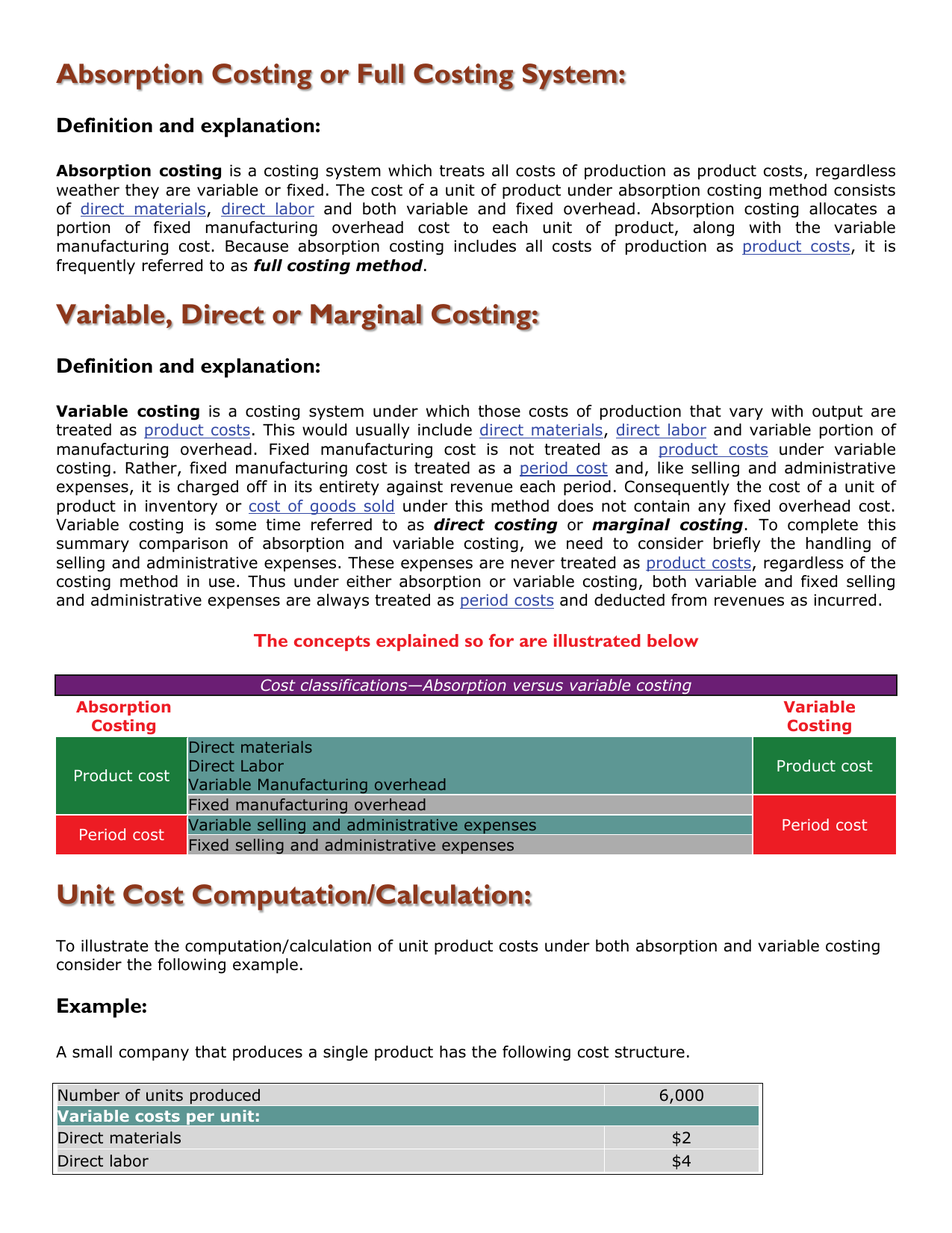

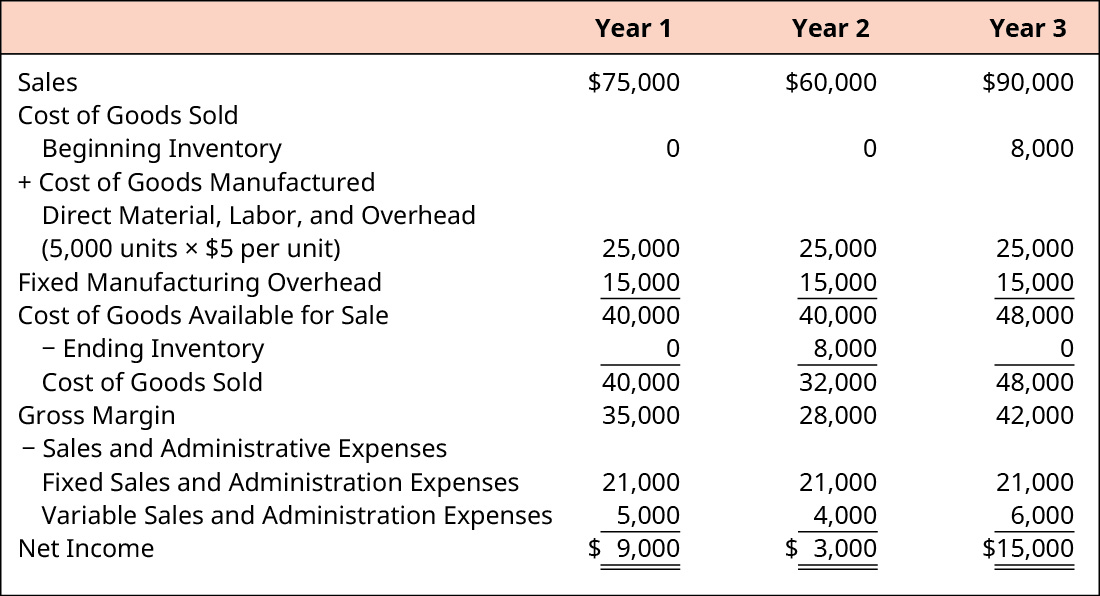

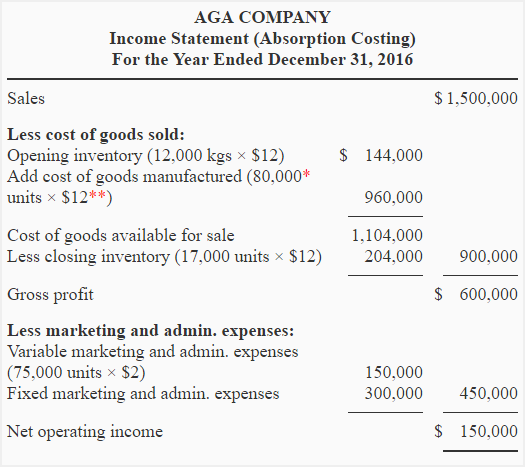

Reconciliation of absorption and variable costing. To generate data for cost volume profit CVP analysis it would be necessary to spend considerable time reworking and reclassifying costs on the absorption statement. Absorption costing includes all the costs associated with the manufacturing of a product while variable costing only includes the variable costs directly incurred in production but not any of the. Prepare an income statement of Alpha Manufacturing Company using variable costing system.

EXERCISE 5-3 Reconciliation of Absorption and Variable Costing Net Operating Incomes LO 5-3J. Absorption costing income statement of a company for the first two years is as follows. Manufacture- heavy-duty transformers for electrical switching stations The company uses variable costing for internal management reports and absorption costing for external reports to shareholders.

Finished goods inventory at the closing of the period. Beachcraft Corporation has fixed manufacturing cost of 12 per unit. What really means by reconciliation.

Reconciliation of Absorption- and Variable-Costing Income 47. These include direct materials direct labor and variable factory overhead. The absorption costing system makes no distinction between fixed and variable costs.

Under variable costing only variable costs are treated as product costs. There is also a variable selling cost of 1 per unit and fixed selling cost of 2000 per month. Reconciliation of Absorption and Variable Costing Net Operating.

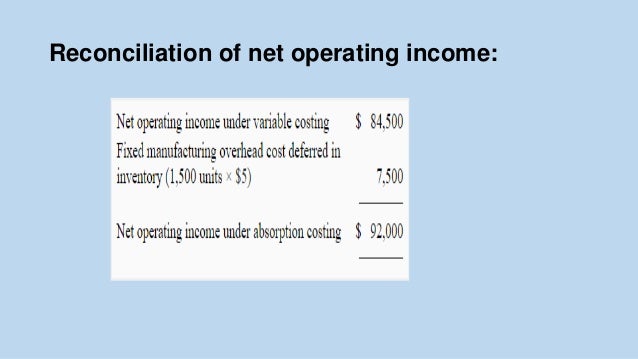

Incomes High Tension Transformers. Absorption Costing Approach Sales 1200x9 10800. Income statements from both methods can be reconciled by starting with the net income or loss using variable costing and adding the amount of fixed costs included in ending inventory and subtracting the fixed costs included in beginning inventory.