Awesome Camel Ratio Analysis

Aswini Kumar Mishra and etal 2013 worked on the financial performance of banks for 12 years period CAMEL model was used for the analysis and the study reveaked that the private sector banks were performing better than the public sector banks in all parameters.

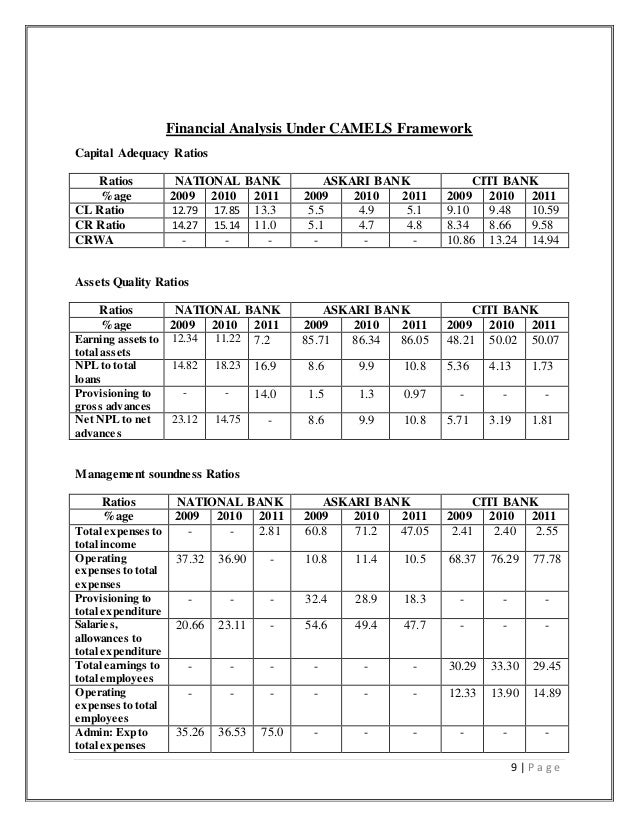

Camel ratio analysis. The analysis disclosed the inability of each component in CAMEL to congregate the full performance of a bank. A popular framework used by regulators is the CAMELS framework which uses some financial ratios to help evaluate a banks performance Yue 1992. The study covered data from annual reports over a period of nine years 1997-2005.

Several studies involve the use of ratios for banks performance appraisal including Beaver 1966 Altman 1968 Maishanu 2004 and Mous 2005. ABSTRACT Camel approach is significant tool to assess the relative financial strength of a bank and to suggest necessary measures to improve weaknesses of a bank. The following three banks from the Indian banking industry were chosen for the Camels Ratio analysis.

It is only used by top management to understand and regulate possible risks. CAMELS is an acronym and stands for. Jan and Marimuthu 2015 said there is less information about sustainability Islamic Bank.

CAMELS is an acronym that represents the six factors that are considered for the rating. Management Efficiency Management efficiency is another important element of the CAMEL Model. CAMEL is a basically a ratio based model to evaluate the performance of bank under various criteria.

RANK of Financial Ratios Defined by CAMEL Each financial institution has a one-line analysis of financial ratios and a one-number summary rank. The analysis was performed from a sample of eleven commercial banks operating in Nigeria. Moreover the best ratios in each CAMEL parameter were determined.

Axis Bank HDFC Bank Punjab National Bank Axis BankAxis Bank was the first of the new private banks to have begun operations in 1994 after the Government of India. The analysis of banking performance has received a great deal of attention in the banking literature. Revisions have been made to the benchmark values used to evaluate the CAMEL key ratios.