Smart Ipsas 5 Borrowing Costs

Exposure Draft 74 IPSAS 5 Borrowing Costs Non-Authoritative Guidance proposes the addition of non-authoritative guidance to IPSAS 5 Borrowing Costs that consists of implementation guidance and illustrative examples to clarify how the existing principles for when borrowing costs can be capitalised should be applied in various regularly encountered public sector contexts.

Ipsas 5 borrowing costs. All the paragraphs have equal authority. IPSAS 1 5. All the paragraphs have equal authority.

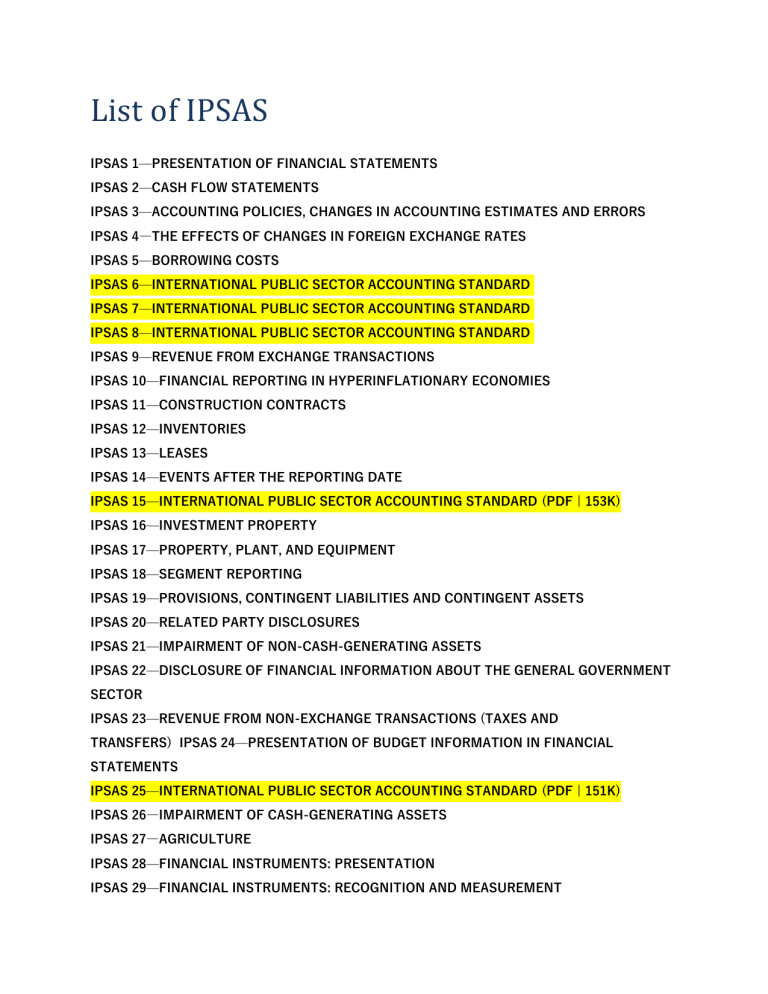

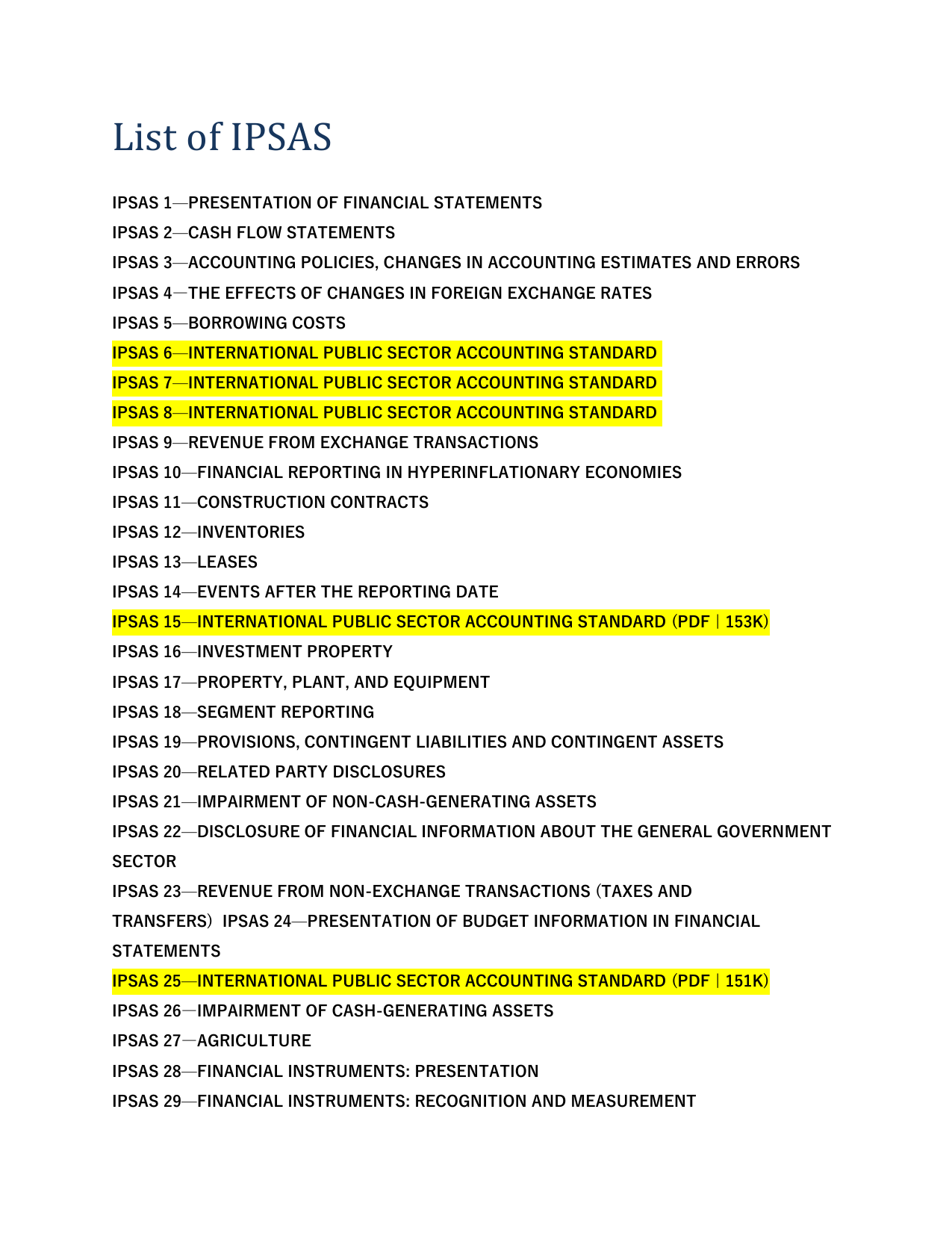

Pages 20 This preview shows page 8 - 10 out of 20 pages. Respondents raised a number of application issues with IPSAS 5 in their responses. IPSAS 6 Consolidated and Separate Financial Statements.

Prescribes the accounting treatment for borrowing costs. IPSAS 5 Borrowing costs should be recognised as an expense in the period in which they are incurred. Oct 21 2020 English.

The objective of IPSAS 5 is to ensure that appropriate recognition criteria and measurement bases are applied to borrowing costs and that sufficient information is disclosed in the notes to the financial statements. IPSAS 5 Borrowing Costs. Consolidated and Separate Financial.

IPSAS 3 Accounting Policies Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies in. IPSAS 51 should be read in the context of its objective. IPSAS 6 10.

BORROWING COSTS IPSAS 5 166 Revenue is the gross inflow of economic benefits or service potential during the reporting period when those inflows result in an increase in net assetsequity other than increases relating to contributions from owners. The ED proposes the addition of non-authoritative guidance to IPSAS 5. In general it requires borrowing costs to be expensed immediately but does permit as an allowed alternative treatment the capitalization of borrowing costs that are directly attributable to the acquisition construction or production of a qualifying asset.